Venture Capital AI: The New Competitive Edge in Investing

Imagine a venture capital partner who can sift through thousands of startups in minutes, spot emerging market trends before they hit the headlines, and keep a real-time pulse on every company in their portfolio. This isn't a person; it's the new reality driven by venture capital AI. Artificial intelligence is quickly moving from a niche tool to a core part of the VC playbook, pushing the industry from gut-feel decisions toward strategies grounded in solid data.

How AI Is Redefining Venture Capital

Think of the traditional investor as a detective with a magnifying glass, limited to the clues right in front of them. Now, picture an AI-powered investor as a detective with a full forensics lab at their disposal. They can uncover hidden patterns and connect dots on a massive scale, making the entire investment process smarter and more efficient than ever before.

Artificial intelligence isn't just another buzzword in the investment world—it's the main event. The numbers are hard to ignore: in the first half of the year alone, AI startups pulled in a staggering $116.1 billion across 2,772 deals, blowing past the previous year's total. By the third quarter, that trend hit overdrive, with AI companies gobbling up 46% of all global venture funding. You can get a deeper look into the state of AI fundraising and its market impact.

This flood of capital signals a clear consensus: AI is where the action is. But it’s not just about funding AI startups; VCs are now turning AI inward to sharpen their own operations.

The New AI-Powered Investment Workflow

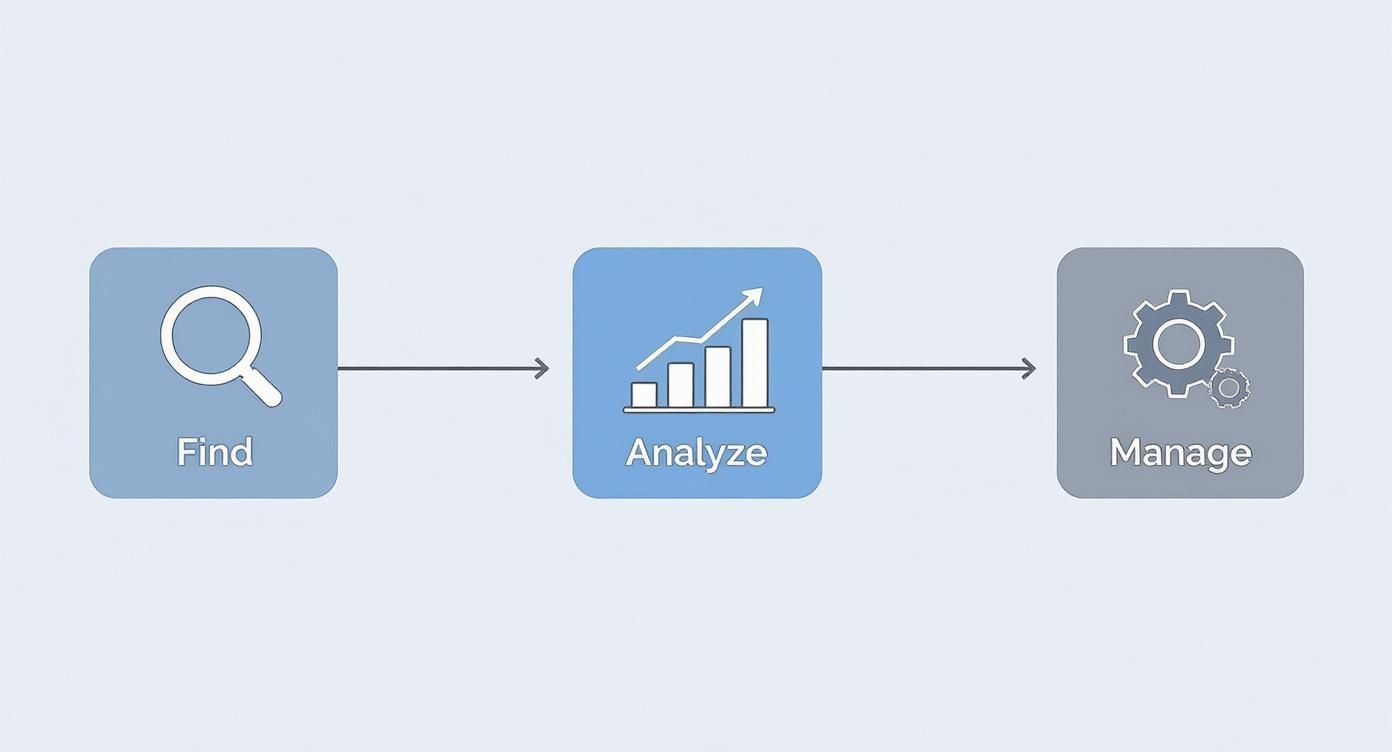

The fundamental jobs of a VC—finding, analyzing, and managing investments—are all getting a serious upgrade from AI. Instead of relying solely on personal networks and endless manual research, firms can now use intelligent systems to get ahead of the competition.

The process flow below shows just how AI plugs into these key stages.

This simple visual breaks down how AI brings structure and data to what was once a highly intuitive, almost artistic, practice. It’s becoming more of a science.

AI is adding a new layer of intelligence to everything, from sourcing deals before they’re on everyone’s radar to figuring out the perfect time to exit an investment. This doesn't replace human expertise, but it definitely enhances it, freeing up investors to focus on strategic thinking and building relationships.

> By automating the heavy lifting of data analysis, venture capital AI frees up partners to do what they do best: identify visionary founders and help them build great companies.

To put it simply, AI helps VCs answer their most critical questions with more speed and accuracy.

- Which startups show the most promise?

- Is this market poised for growth, or is it contracting?

How is our portfolio company really* doing compared to its rivals?

This guide will walk you through each stage of this new workflow, showing you exactly how venture capital AI is becoming the new standard for modern investing.

To give you a quick snapshot, the table below breaks down how AI is changing the game at each step of the VC process.

AI's Impact Across the VC Workflow

| VC Stage | Traditional Method | AI-Powered Method | Key Benefit |

|---|---|---|---|

| Deal Sourcing | Relying on networks, conferences, and inbound pitches | AI algorithms scan public and private data to find high-potential startups | Wider reach and discovery of "hidden gem" opportunities |

| Due Diligence | Manual review of financials, market research, and team backgrounds | AI analyzes vast datasets to assess risk, predict market size, and model outcomes | Deeper, faster, and more objective analysis |

| Portfolio Management | Periodic check-ins and manual performance tracking | Real-time monitoring of company health, market signals, and KPI dashboards | Proactive support and early identification of risks or opportunities |

| Exit Strategy | Timing exits based on market conditions and intuition | Predictive models identify optimal exit windows and potential acquirers | Data-driven timing to maximize investment returns |

As you can see, AI isn't just making small tweaks; it's fundamentally reshaping how investors find, fund, and grow the next generation of groundbreaking companies.

Finding Deals Before They Go Mainstream

For decades, venture capital deal sourcing ran on a pretty standard playbook. Investors leaned on personal networks, hit the conference circuit, and waited for those coveted warm introductions. It worked, but this old-school method has a big blind spot—it often misses incredible opportunities bubbling up just outside an investor's immediate circle.

It's a bit like fishing in a small, familiar pond while a whole ocean of innovation sits just over the hill.

Today, venture capital AI tools act like tireless digital scouts, systematically scanning that ocean. These platforms don’t just sit back and wait for deals to land in their inbox. They actively hunt for faint signals that point to a promising startup long before it ever makes headlines. They sift through millions of data points across the web, connecting dots that a human just couldn't see.

Creating an Innovation Heat Map

You can think of this process as AI building a real-time "heat map" of innovation. By pulling together all sorts of disconnected information, these algorithms can pinpoint exactly where momentum is building, often in highly specific niches. They look past the polished pitch deck and focus on what's actually happening on the ground.

What kind of clues are they looking for?

- Patent Filings: Often the earliest signs of brand-new tech and valuable intellectual property.

- Academic Research: AI can spot groundbreaking papers from universities that could be the seed of a future company.

- Developer Activity: Watching open-source projects shows which technologies are genuinely capturing engineers' interest.

- Hiring Trends: A surge in job postings, especially for technical roles, is a classic sign an early-stage company is hitting a growth spurt.

By pulling all these signals together, venture capital AI doesn't just find individual companies; it uncovers entire trends as they’re taking shape. This gives investors a huge leg up, letting them connect with founders who are creating a new market, not just chasing an existing one.

From Data Points to a Curated Watchlist

So, what does this look like in practice? Let's say a firm wants to find promising startups in "AI for drug discovery." The old way would involve calling a few experts. The new way is much more powerful.

An analyst can use an AI-powered platform to set hyper-specific criteria and generate a list of companies that are a perfect fit.

Here’s a clear example:

A VC firm could use a tool to find early-stage companies that tick these boxes:

- Technology Signal: Have recently filed patents related to machine learning in drug discovery.

- Team Signal: Founders or key engineers previously worked at big-name biotech or AI firms like Genentech or DeepMind.

- Traction Signal: Show a 30% or greater jump in engineering hires over the past six months.

- Community Signal: Are active contributors to relevant open-source bioinformatics projects.

- Financial Health Analysis: AI models can scan financial statements to spot red flags like an unusually high burn rate or cash flow problems that a human might easily miss.

- Competitive Benchmarking: An algorithm can compare a startup’s key performance indicators (KPIs)—think customer acquisition cost (CAC) and lifetime value (LTV)—against anonymized industry averages.

- Team Assessment: Some advanced tools can even analyze the professional histories of the founders, looking for patterns of past success or failure that correlate with future outcomes.

- Revenue Forecasting: Based on current growth and the total market size, what’s a realistic revenue projection in three to five years?

- Market Share Projection: How much of the target market can this company actually capture, and how fast can they do it?

- Risk Assessment: What are the biggest risks, and what’s the probability of failure based on historical data from similar companies?

- Cash Burn Rate: AI can project when a company is set to run out of cash based on current spending, sending an alert if the burn rate suddenly spikes.

- Customer Churn: By analyzing user behavior, an algorithm can spot customers who are likely to cancel, giving the team a chance to step in and save the account.

- Product Engagement: AI tracks how people are actually using a product, pinpointing drops in engagement that could point to a buggy new feature or a faltering product-market fit.

- AI's Role: It can chew through millions of data points to spot trends, flag potential risks, and run predictive models. The AI delivers "the what."

- Human's Role: The investor's job is to take that data, understand its context, build a relationship with the team, and provide strategic guidance. They provide "the why" and "the how."

- Bad Data, Bad Results: The old saying "garbage in, garbage out" has never been more true. If your AI model is fed incomplete or inaccurate data, its insights will be worthless.

- Hidden Biases: AI models learn from historical data. If that data reflects past biases—like overlooking founders from certain backgrounds—the AI will learn and amplify those same biases.

- The "Black Box" Problem: Some of the more complex AI models can be a complete mystery. They spit out an answer, but you have no idea how they got there. This lack of transparency makes it tough to trust the recommendation or hold anyone accountable.

The AI then crunches the numbers and spits out a curated watchlist. Instead of a couple of names from their network, investors get a data-backed list of dozens of hidden gems all showing clear signs of momentum.

This screenshot from the CB Insights platform shows how these tools help investors track markets and spot key players.

Dashboards like this turn raw data into real strategic insights, showing investment trends, competitor moves, and overall market health so VCs can source deals more effectively.

> This data-driven approach allows venture capitalists to move from reactive deal flow to proactive opportunity hunting. It's about finding the wave as it's forming, not after it has already crested.

Ultimately, this shift makes deal sourcing more efficient and, frankly, more democratic. Great ideas can come from anywhere. With venture capital AI, investors finally have the tools to find them, no matter the founder's zip code or connections. This opens up the playing field and seriously increases the odds of finding the next truly game-changing company.

Using Data to Validate a Startup's Potential

Once an AI sourcing engine flags a promising startup, the real work begins. This is due diligence—the notoriously manual, time-consuming phase where investors bury themselves in spreadsheets and market reports, trying to separate hype from reality. But now, venture capital AI is fundamentally changing this crucial step, pushing the process away from gut feelings and toward data-backed conviction.

Instead of spending weeks just gathering information, investors can now use AI tools that act like a whole team of analysts working around the clock. These systems can instantly dissect a company’s financial health, benchmark its performance against competitors, and even size up the founding team’s track record, all in a tiny fraction of the usual time.

This analytical power is turning due diligence from a qualitative art into a quantitative science. It allows investors to stress-test a startup's claims with hard data, leading to much sharper insights.

Verifying Growth and Market Fit

One of the biggest headaches during due diligence is simply confirming a startup's growth metrics. A pitch deck might boast explosive user acquisition, but how does an investor know if those numbers are real and sustainable? AI provides the tools to cross-reference these claims against what’s happening in the real world.

For instance, an AI platform can analyze public app store data, web traffic trends, and social media sentiment to check if a company's reported user growth holds up. If a founder claims their user base doubled last quarter, but web traffic has been flat, the AI will flag that inconsistency immediately. It’s like having an automated truth detector.

This kind of rigorous, automated process is at the heart of effective market validation. If you want to dig deeper into the concept, our guide on what is market validation offers a great overview of the principles behind confirming a strong product-market fit.

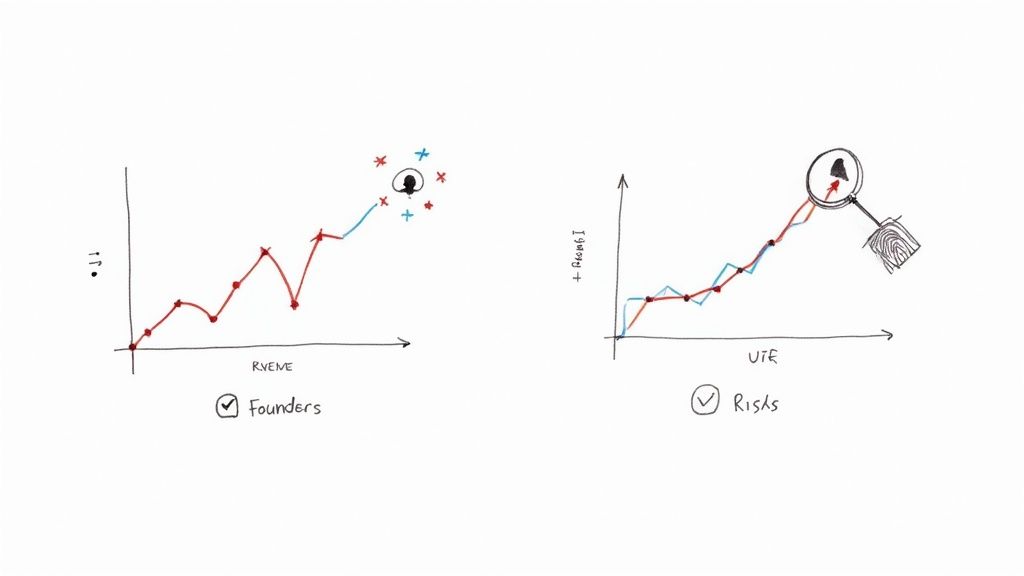

Predicting Future Performance

Beyond just checking the past, the most sophisticated venture capital AI platforms use predictive analytics to peek into a startup's future. By training machine learning models on huge datasets of both successful and failed companies, these systems learn to identify the subtle signals that point toward a high-growth trajectory.

> Predictive models give investors a clearer picture of the potential return on investment by forecasting key outcomes like future revenue, market share, or even the likelihood of a successful exit. This data-driven foresight is essential for reducing investment risk.

This intense focus on AI-driven analysis is also reshaping the investment landscape. There's now a clear split between AI and non-AI startups. While the total number of VC deals for AI rounds actually saw a 13% decline year-over-year, AI companies continue to pull in a disproportionate amount of funding, with AI unicorns grabbing an ever-larger piece of the pie. You can read more about how AI is reshaping global investment trends on ropesgray.com. This split really underscores how critical data-backed validation has become.

These predictive tools help investors get answers to the big questions:

By turning due diligence into a data-driven exercise, venture capital AI helps investors make smarter, faster, and more confident decisions. It replaces guesswork with evidence, empowering firms to build a portfolio filled with companies that have a statistically higher chance of success.

Guiding Portfolio Companies to Success with AI

A VC's work doesn't stop once the check is signed. In fact, that's often when the real work begins. The post-investment phase—guiding a startup from a promising idea to a market leader—is where value is truly created, and venture capital AI is quickly becoming an indispensable partner in that journey. It helps shift portfolio management from a series of occasional, manual check-ins to a continuous, data-backed support system.

Think of it like upgrading a ship's navigation. The old way was getting a performance report once a month, kind of like a weather update every few days. An AI-equipped firm gets a live feed of data, letting them see the storm clouds gathering long before the rain starts.

Creating an Early Warning System

One of the most powerful ways AI helps is by creating an "early warning system." Modern AI dashboards can plug directly into a company's core operational systems, tracking key metrics as they happen. This gives VCs a live view of a startup's health, flagging red flags before they turn into full-blown crises.

These systems keep a close eye on vital signs like:

Imagine an AI sending a notification to a VC partner that customer sentiment for one of their companies just took a nosedive, based on social media chatter and support tickets. This lets the VC proactively call the founders to help figure out what's wrong—be it a software bug or a marketing message that missed the mark.

AI as a Strategic Growth Partner

Beyond just spotting trouble, venture capital AI is a fantastic tool for creating value. By crunching massive amounts of industry-wide data, AI platforms can uncover growth opportunities that a single management team, buried in day-to-day operations, might completely miss. This changes the VC's role from a simple investor to a strategic co-pilot.

> AI doesn't just manage risk; it surfaces opportunities. By analyzing market trends and competitive landscapes, it helps VCs provide their portfolio companies with actionable, data-driven advice for growth.

This kind of strategic support comes in many forms. For example, an AI tool might pinpoint ideal companies for strategic partnerships by finding businesses with complementary tech and similar customer bases. Or, it could suggest new markets to enter by identifying underserved niches that align perfectly with the startup's core product.

Uncovering Growth Levers with Data

AI-powered insights push portfolio companies to make smarter operational decisions. With the right business intelligence tools, founders get a much clearer picture of what actually drives their growth and where they should invest their limited resources. For a closer look at this, check out our guide on SaaS business intelligence tools that help companies turn raw data into smart moves.

Even hiring gets an upgrade. Some AI platforms can suggest key hires by analyzing the career trajectories of successful executives at similar companies, helping startups build a top-tier team much faster. By bringing these intelligent systems into the fold, VCs give their portfolio companies a real competitive edge. They help them navigate bumps in the road and jump on opportunities with more speed and confidence, showing that venture capital AI is just as much about building great companies as it is about finding them.

Predicting the Best Time to Exit

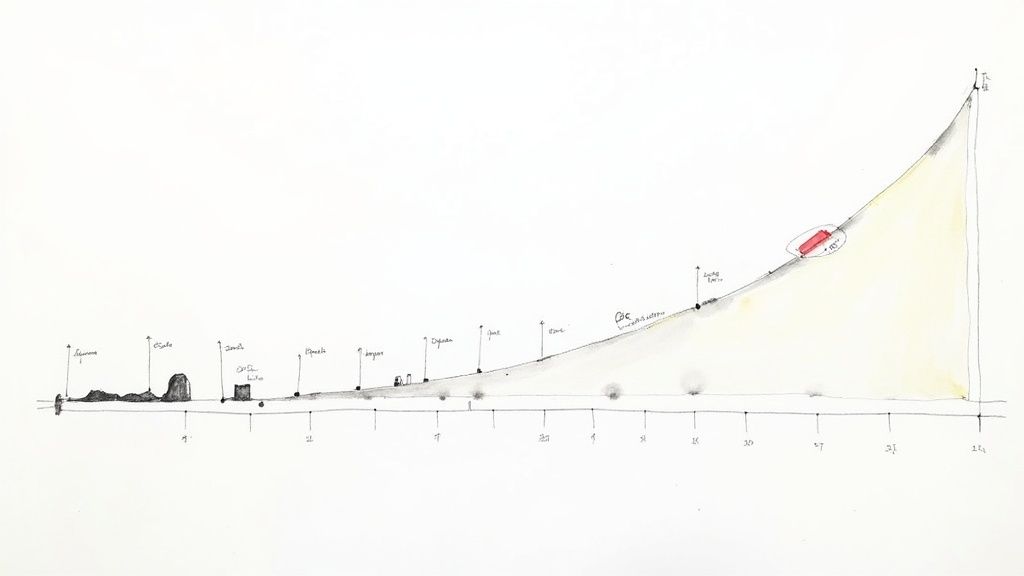

Knowing when to get into a deal is only half the battle. Knowing when to get out is just as important for locking in those big returns. This is where some of the most sophisticated venture capital AI tools are making their mark, turning exit planning from a reactive guessing game into a data-driven strategy.

Machine learning models can now sift through years of M&A data, IPO performance, and market trends for specific sectors. By analyzing thousands of past deals, they spot the subtle signals that suggest an ideal exit window is about to open. It’s like giving VCs a crystal ball, but one that’s backed by hard data.

From Gut Feel to Data-Backed Timelines

For a long time, exit decisions were driven by gut feelings and a bit of luck. VCs would essentially wait for a good acquisition offer to show up or for the public markets to heat up. AI completely flips that on its head. It helps predict these opportunities before they even happen, giving firms time to get their portfolio companies ready for a big win.

Here’s a practical example: A VC has a SaaS company in its portfolio. An AI model could analyze thousands of similar companies and find that high-growth SaaS firms in that specific niche tend to get acquired within five to seven years after their Series A round. The model can even pinpoint the specific metrics, like hitting a certain level of annual recurring revenue (ARR), that make a company a prime acquisition target.

> This predictive power allows VCs to work backward from a data-driven timeline. Instead of hoping for a good exit, they can strategically guide a company to hit the milestones that historically lead to one.

This proactive approach makes sure a startup is in the best possible shape when buyers or public markets come knocking, which is key to getting the highest valuation. If you want to dive deeper into the nuts and bolts of that process, our guide on how to value SaaS companies breaks down the metrics that really matter.

Identifying Potential Acquirers and Market Windows

Beyond just figuring out when to exit, venture capital AI can also point to who is most likely to buy a startup. These systems scan the market, looking for companies that have made similar acquisitions before or have strategic goals that line up with the startup’s tech. The result is a targeted list of potential buyers, which makes outreach far more effective.

Market timing is everything, too. Right now, for instance, there’s an incredible amount of capital flowing into AI. We’re seeing massive funding rounds become the norm, with foundation model developers raising eye-watering sums. In just one recent quarter, AI companies snagged the top three venture rounds: Anthropic raised $13 billion, xAI brought in $5.3 billion, and Mistral AI secured $2 billion. In fact, Anthropic’s raise alone accounted for a staggering 29% of all venture capital that went to AI companies during that period. You can read more about these massive funding deals on crunchbase.com.

This kind of data clearly signals when a sector is "hot," creating the perfect window for an exit. An AI model might see this trend and flag that a portfolio company in a related field should speed up its exit plan to cash in on the market's excitement. By mixing predictive timing with smart buyer identification, AI gives VCs a much clearer roadmap to a profitable exit.

Balancing AI Insights with Human Expertise

While venture capital AI brings some serious analytical firepower to the table, it's just as important to recognize what it can't do. An algorithm can't shake a founder's hand and feel their conviction. It can't read the room during a tough board meeting or offer the kind of battle-tested advice that helps a startup navigate a crisis.

These deeply human elements are still the absolute core of venture capital. The real magic happens when you stop thinking about AI as a replacement for investors and start seeing it as a partner. This idea is often called augmented intelligence—think of AI as an incredibly sharp co-pilot, not the one flying the plane.

The Augmented VC Model

In practice, this means AI does the heavy lifting with data, which frees up VCs to focus on the high-level strategic work that humans do best. It’s a smart way to divide the labor, playing to the unique strengths of both.

For example, an AI might flag a startup for its incredible user growth metrics. But it takes a person to sit down with the founders and get a real sense of their grit, their vision, and whether they have what it takes to lead a team through the inevitable tough times.

> The future of venture capital isn't man versus machine; it's man with machine. AI insights are the starting point for a deeper conversation, not the final word.

This synergy lets venture capitalists operate on a completely different level. Instead of being buried in spreadsheets, they can invest their time where it truly counts: mentoring founders, making game-changing introductions, and helping their portfolio companies navigate tricky market shifts. These are things where human experience is simply irreplaceable.

AI Enhances, It Doesn't Replace

At the end of the day, venture capital AI is a tool. It’s a powerful one, but it’s still just a tool. It sharpens an investor's gut feeling with hard data, but it can never be a substitute for sound judgment.

A predictive model might suggest a company is on track for a great exit, but it's the VC's personal network and negotiation skills that actually get the deal done on the best possible terms.

The goal isn't to automate the human element out of the equation. It's to blend the incredible speed and scale of artificial intelligence with the wisdom, intuition, and relationship-building skills of an experienced investor. By embracing AI as a collaborator, VCs can make smarter bets, help build stronger companies, and ultimately drive more innovation.

Answering the Big Questions About AI in Venture Capital

As AI makes its way into the venture capital world, it’s only natural to have a few questions. Let's tackle some of the most common ones to get a clearer picture of how this tech really works in practice.

Is AI Going to Replace Venture Capitalists?

Not a chance. Think of AI as a powerful partner, not a replacement. It’s fantastic at crunching massive datasets and spotting patterns, which frees up VCs to do what they do best: build relationships, mentor founders, and make strategic judgment calls.

AI gives you the data-driven "what," but it's the human investor who provides the crucial "why" and "what now?" It simply can't replicate the intuition and human connection that defines great venture investing. The future here is a partnership—human with machine, not one against the other.

What Are the Biggest Dangers of Using AI in VC?

AI is a powerful tool, but it's not without its pitfalls. Firms need to be smart about the risks involved. Relying too heavily on a flawed algorithm or bad data can lead you straight to a bad investment.

Here are the main things to watch out for:

> The real danger isn't the technology itself. It's blindly trusting it without a healthy dose of human skepticism. Smart firms use AI to start a conversation, not to have the final say.

How Much Does It Actually Cost to Get Started?

The cost of bringing venture capital AI into your firm can vary wildly. It really depends on whether you're buying a ready-made tool or building something from scratch.

A smaller, boutique firm could get started with an off-the-shelf SaaS tool for a few thousand dollars per user per year. On the other end of the spectrum, a large, established VC might spend millions building a proprietary AI engine with a dedicated team of data scientists and engineers. There's an option for just about any budget.

---

Ready to stop guessing and start building? Proven SaaS gives you a data-backed unfair advantage by showing you which SaaS ideas are already profitable. We analyze millions of ads to surface validated niches where real companies are spending big, signaling strong market demand. Find your next great idea today.

Learn more and get started at https://proven-saas.com.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders