A Clear Guide on How to Value SaaS Companies in 2024

Trying to value a SaaS company with traditional business metrics is like trying to measure water with a ruler—it just doesn't work. The old rules, built for one-time sales and physical assets, completely miss the magic of a subscription business.

Why Traditional Valuation Fails for SaaS

Here's a simple example: a local bakery sells a cake for $30. That’s a single, one-time transaction. But a SaaS company with a $30 per month subscription can turn that one customer into $360 in the first year and potentially thousands over their lifetime.

This is the key difference. The SaaS model is built on predictable, recurring revenue, which gives a much clearer window into a company's future health than a history of one-off sales ever could.

The Power of Predictable Revenue

Because the entire model is built on steady, repeatable income, we need different tools to measure it. This is where a metric like Annual Recurring Revenue (ARR) becomes crucial. Instead of just looking at last year's profits, ARR gives us a forward-looking glimpse based on contracts already signed.

Ultimately, a business's value is all about its future cash flow. For SaaS companies, ARR is the best crystal ball we have. It’s not just a number; it’s a direct measure of the company’s momentum.

This is why investors and buyers focus on three key questions:

- Growth: How fast is new recurring revenue coming in?

- Retention: Are customers sticking around for the long term?

- Profitability: How much of that revenue actually becomes profit?

> The Simple Truth: Valuing a SaaS company is less about what it earned last year and more about what it is contractually expected to earn next year. Recurring revenue fundamentally changes the risk profile and growth potential.

This entire dynamic is amplified by the explosive growth of the SaaS market itself. The global market is on track to hit around $300 billion by 2026, with an annual growth rate of over 20%. When the whole industry expands that quickly, it supports higher valuations across the board. If you look at current SaaS market statistics, you'll see just how massive this trend is.

Getting to Grips with Key SaaS Valuation Metrics

To understand what a SaaS company is really worth, you need to speak its language. A few core metrics tell you more about a company's health and future potential than a standard financial statement ever could. These are the numbers that smart investors use to spot a future unicorn.

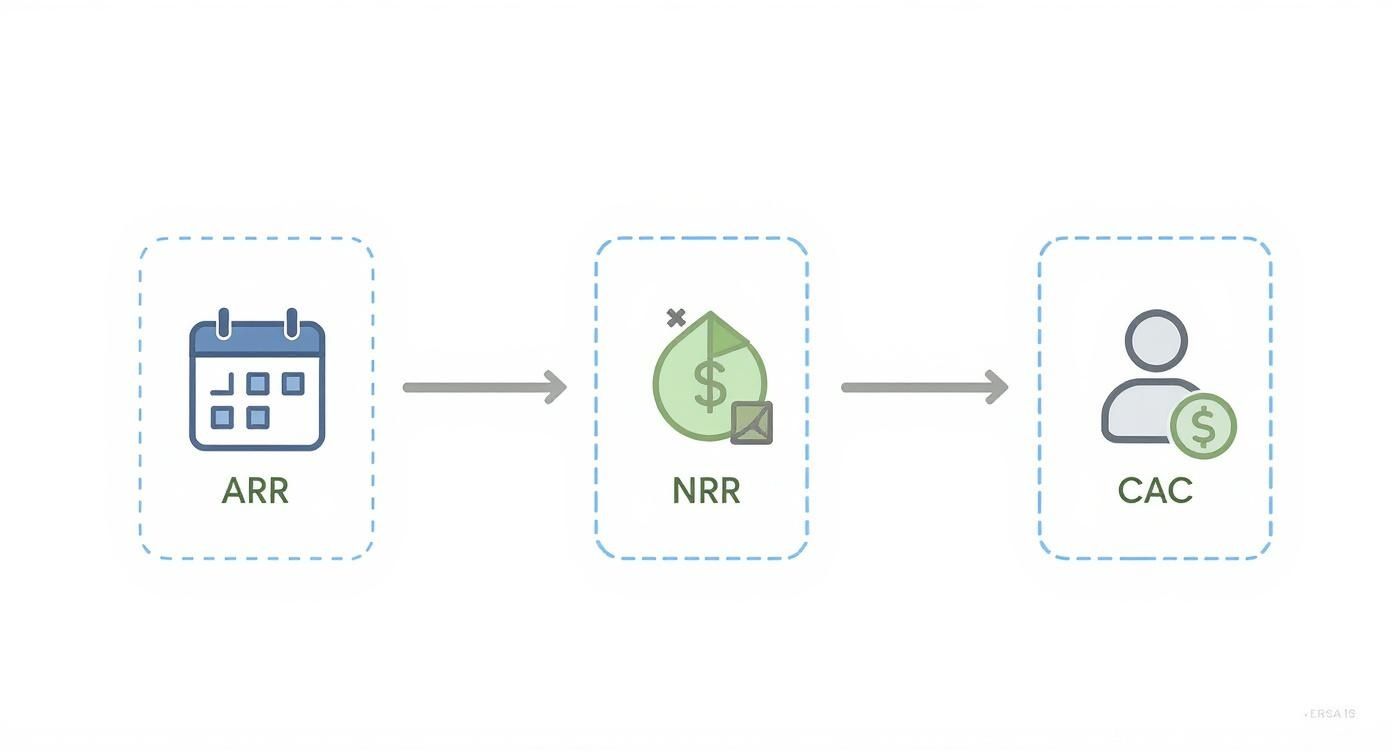

It all starts with Monthly Recurring Revenue (MRR). This is the predictable income a company brings in every single month. Multiply that by 12, and you have its Annual Recurring Revenue (ARR)—the absolute bedrock of any SaaS valuation.

For example, if a marketing tool has 200 customers paying an average of $100 a month, its MRR is $20,000. That gives it an ARR of $240,000. These two numbers provide a quick snapshot of the company's size, but the real story is in the details.

Looking Beyond the Surface: Customer Loyalty and Growth Potential

Sustainable growth isn't just about adding new customers. It's about keeping the ones you have and getting them to spend more over time. This is where Net Revenue Retention (NRR) comes in, and it’s a game-changer.

NRR tracks the revenue from your existing customers, including both upgrades (expansion) and downgrades or cancellations (churn).

An NRR over 100% is a massive green flag. It means the company is making more money from its current customers than it's losing. A business with 115% NRR is essentially growing by 15% every year before it signs a single new customer.

> Why NRR Matters: A high NRR proves your product is essential to your customers. It's a compounding growth engine that makes a business far more valuable and less risky.

Of course, you still need new business to scale. That brings us to Customer Acquisition Cost (CAC)—what you spend to land one new customer. By itself, CAC is just an expense. The magic happens when you pair it with Customer Lifetime Value (LTV), the total revenue you expect from a customer over their entire relationship.

A healthy LTV to CAC ratio—ideally 3:1 or higher—is the sign of a profitable growth machine. If it costs you $2,000 to acquire a customer (CAC) who will ultimately generate $9,000 for you (LTV), you have a fantastic model. Keeping track of these numbers is much easier with the right SaaS business intelligence tools that can automate the process for you.

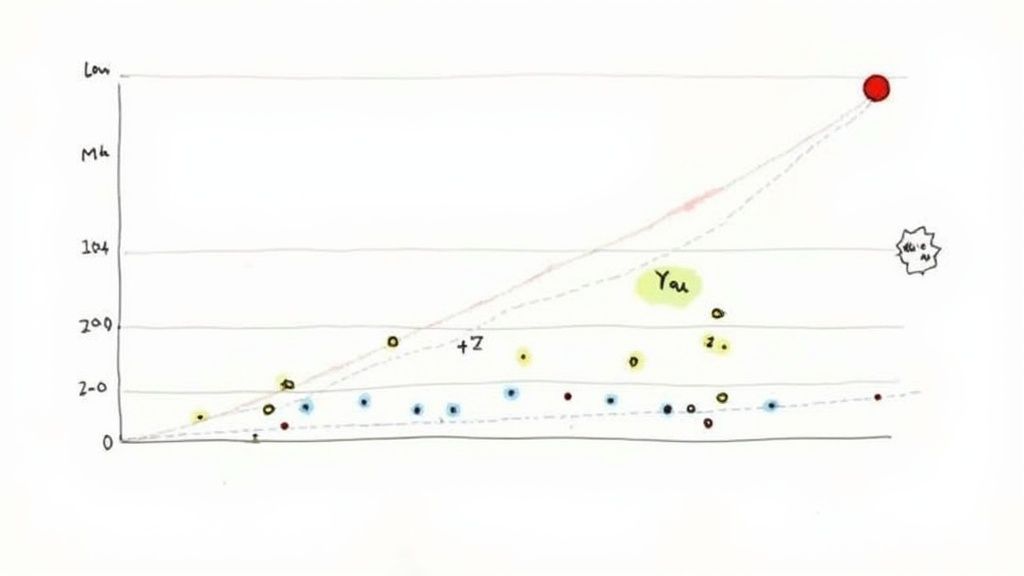

This chart from SaaS Capital perfectly illustrates how top-tier metrics lead to premium valuations for public SaaS companies.

Just look at the data. Companies like Crowdstrike and ServiceNow, known for incredible growth and retention, earn ARR multiples that blow the median out of the water. It’s a clear demonstration of how directly these core SaaS metrics drive a company’s final price.

The ARR Multiple Method Explained

When valuing a SaaS company, one method is king: the ARR Multiple Method. It’s the go-to approach because it’s simple and directly reflects the subscription-based nature of the business. The formula couldn't be easier: Valuation = Annual Recurring Revenue (ARR) x Multiple.

This method puts ARR front and center because it represents the predictable, contracted revenue a company can expect over the next 12 months. While finding the ARR is simple math, the real challenge—and where the expertise comes in—is figuring out the multiple.

That multiple isn’t just a random number. It's a direct reflection of the company's health, its growth potential, and the overall quality of the business. A higher multiple signals a more valuable and attractive company.

What Really Drives the Multiple

Investors don't guess when it comes to the multiple. They justify it with a handful of critical metrics that tell the story of where the company is headed. A business with strong fundamentals will always command a premium.

Here are the three most important drivers:

- Growth Rate: This is the big one. How fast is the company's ARR growing year-over-year (YoY)? Rapid growth shows strong market demand and product-market fit.

- Net Revenue Retention (NRR): An NRR over 100% is a game-changer. It means you're making more money from existing customers than you're losing from churn. This creates a powerful, compounding growth engine.

- Gross Margin: This tells you how much profit the company makes from its core service. For software, you want to see high gross margins—typically 75% or more—as it signals an efficient and scalable business.

This simple visual breaks down how these key metrics work together to give you a full picture of a company's health.

As you can see, ARR is the foundation, but metrics like NRR and CAC provide the essential context around customer health and growth efficiency.

Multiples in the Real World: Two Examples

Let’s see how this plays out with two similar companies.

Company A (High Growth):

- ARR: $2 Million

- YoY Growth: 100%

- NRR: 120%

- Multiple: Given its incredible growth and stellar retention, an investor might assign a 12x multiple.

- Valuation: $2M x 12 = $24 Million

Company B (Mature Growth):

- ARR: $2 Million

- YoY Growth: 25%

- NRR: 95% (losing 5% of existing revenue each year)

- Multiple: With slower growth and some churn, it might only get a 5x multiple.

- Valuation: $2M x 5 = $10 Million

They both have the exact same revenue, but Company A is worth more than double Company B. That’s the ARR multiple method in action. It rewards quality and momentum, not just top-line revenue.

> Key Takeaway: The multiple is where the story of the business is told. It's the market's vote of confidence in a company's ability to grow efficiently for years to come.

SaaS Growth Rate and Corresponding ARR Multiples

This table shows how different growth rates typically translate into different valuation multiples. It's a quick cheat sheet for understanding how investors think about a company's trajectory.

| YoY ARR Growth Rate | Typical ARR Multiple Range | Company Stage |

|---|---|---|

| 100%+ | 10x - 15x | Hyper-Growth |

| 50% - 100% | 7x - 10x | High-Growth |

| 20% - 50% | 5x - 8x | Mature Growth |

| <20% | 3x - 5x | Established |

Of course, these are just benchmarks. Factors like NRR, gross margin, market size, and overall market sentiment can push these numbers up or down. To dig deeper, you can explore resources on how SaaS valuation multiples are determined and see how these ranges fluctuate with market conditions.

Benchmarking Against the SaaS Market

A valuation created in a vacuum is just a number. Once you understand a company's internal metrics, you need to see how it stacks up against the competition. This is where benchmarking comes in. It grounds your valuation in reality.

After all, how do you know if a 9x multiple is a great deal or an overpayment? Without market context, you're flying blind. Public company data, while not a perfect mirror for private businesses, provides an essential frame of reference. It shows you what the market is willing to pay for different levels of growth and profitability.

Finding Your Place in the Market

The SaaS world isn't one-size-fits-all. A company's funding status, for example, dramatically changes how it's valued. Bootstrapped companies, which grow using their own profits, are typically judged on their efficiency. On the other hand, venture-backed companies are all about hyper-growth, even if it means burning cash.

These different paths lead to different valuation multiples. The SaaS Capital Index™ shows that private SaaS valuation multiples are currently hovering around 7.0 times ARR.

But when you dig deeper, the story gets more interesting. Bootstrapped businesses tend to trade around 4.8x ARR, while their equity-backed peers average closer to 5.3x ARR. You can see the full breakdown in their report on private SaaS company valuation multiples.

This is why context is king. A bootstrapped company pulling a 5x multiple might be a star performer. A VC-backed firm at that same multiple could be seen as a laggard.

> Remember: A valuation is a story you tell with numbers. Benchmarking provides the context that makes your story believable.

Using the Rule of 40

One of the most useful benchmarks is the Rule of 40. It's a simple gut check: a healthy SaaS company's year-over-year growth rate plus its profit margin should add up to 40% or more.

Let’s look at a few clear examples:

- The High-Growth Star: A company growing at 50% annually but with a -10% profit margin still passes (50 - 10 = 40).

- The Steady Performer: A business growing at a modest 20% with a solid 25% profit margin is also in great shape (20 + 25 = 45).

- The One That's Struggling: A company with 15% growth and a 5% margin falls short (15 + 5 = 20), signaling potential issues.

This metric is powerful because it's balanced. It acknowledges that there's more than one way to build a great SaaS company. It forces a real conversation about the trade-offs between grabbing market share and building a sustainable business. Companies that consistently beat the Rule of 40 almost always command higher multiples because they've proven they can grow efficiently.

To get a better handle on where a company fits, our guide on conducting effective SaaS market research can help you map out the competitive landscape.

A Practical SaaS Valuation Walkthrough

Theory is great, but let's walk through a real-world example to see how all these pieces fit together.

Imagine we're valuing "ConnectSphere," a project management tool for remote teams. They’ve bootstrapped their way to an impressive scale and are now considering an exit.

After looking at their financials, here are the numbers that matter most:

- Annual Recurring Revenue (ARR): $5,000,000

- YoY ARR Growth Rate: 80%

- Net Revenue Retention (NRR): 115%

- Gross Margin: 85%

These metrics alone tell a compelling story. An 80% growth rate puts them squarely in the "high-growth" camp, showing they’ve found strong product-market fit.

Justifying the Valuation Multiple

Now for the most important part: picking the right multiple. Based on market data, companies growing this fast usually trade for somewhere between 7x and 10x ARR. So, where does ConnectSphere land?

This is where the other metrics come in. Their 115% NRR is stellar. It proves customers are sticking around and spending more over time—a powerful growth engine. On top of that, an 85% gross margin is best-in-class for software, signaling an incredibly efficient business.

Arguing for a 6x multiple would ignore their incredible momentum. Pushing for a 12x multiple might be a stretch, as those are typically reserved for companies growing over 100% YoY.

> Pro Tip: Choosing a multiple isn't a guess. It’s about building a defensible story backed by hard data. Killer metrics like high NRR and strong gross margins are what you use to argue for a premium valuation.

Given their impressive growth, fantastic retention, and top-tier margins, a 9x ARR multiple feels right. It’s a strong, defensible number that reflects their premium performance.

Calculating the Final SaaS Valuation

Once we’ve landed on a justified multiple, the rest is simple math.

The formula is straightforward: Valuation = ARR x Multiple

Let's plug in the numbers for ConnectSphere:

- Valuation = $5,000,000 (ARR) x 9 (Multiple)

- Final Valuation = $45,000,000

This $45 million valuation isn't a random guess. It’s a logical conclusion based on a clear analysis of the company’s performance, stacked up against what the market is willing to pay. This process is a reliable framework you can use for valuing almost any SaaS business.

Common SaaS Valuation Questions

Even with a solid framework, some specific questions always come up. Let's tackle the most common ones.

How Much Does Profitability Really Matter?

For a long time, growth was the only thing that mattered. That's changed. Now, profitability is a huge factor in a SaaS company's valuation.

The go-to benchmark here is the ‘Rule of 40.’ It’s a simple formula: your Growth Rate + Profit Margin should be more than 40%. If you hit that mark, you're showing the kind of efficient, sustainable growth that investors love, and they'll reward you with higher multiples.

For example, a company burning cash to achieve massive growth might actually get a lower multiple than a slower-growing but profitable one. Today's market wants to see a clear path to profit.

How Do You Value a Young Startup vs. an Established Player?

Valuing a SaaS business isn't one-size-fits-all. The company's age and maturity completely change the game.

- Early-Stage Companies: Here, you're betting on potential. The valuation is about the size of the market, the strength of the team, and early signs of traction. Multiples might seem high for a small revenue base, but they reflect the huge potential upside. Proving you have a product people need is everything. If you're at this stage, you need to find product-market fit in our detailed guide.

- Mature Companies: With established businesses, the focus shifts from potential to performance. We're looking at hard numbers—predictable revenue, Net Revenue Retention (NRR), and profitability. The growth multiples might not be as explosive, but the valuation is built on a much larger, stable revenue foundation, which means less risk.

> The Difference: An early-stage valuation is a bet on the future, driven by vision. A mature-stage valuation is an assessment of the present, grounded in proven performance.

Are There Other Ways to Value a SaaS Company Besides ARR Multiples?

Absolutely, though ARR multiples are the gold standard for most private SaaS companies. It’s simple, direct, and gets right to the heart of the recurring revenue model.

That said, for larger, more profitable companies, other methods can add valuable context. A Discounted Cash Flow (DCF) analysis projects future cash flows to figure out what they're worth today. Another technique is looking at Comparable Transactions—checking what similar companies have recently sold for.

But at the end of the day, for its pure focus on the subscription engine, the ARR multiple remains the most trusted tool in the shed.

---

Ready to stop guessing and start building? Proven SaaS uses AI to analyze thousands of ads and uncover profitable, validated SaaS ideas with real market demand. Find your next winning idea today.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders