The Four Steps to Epiphany: Your Guide to Building a SaaS That Sells

Ever heard the startup advice, "build it and they will come"? It's a romantic idea, but it’s also a direct path to failure. This flawed thinking is exactly what Steve Blank's book, The Four Steps to the Epiphany, was written to prevent. It’s a framework that flipped the old way of building companies on its head.

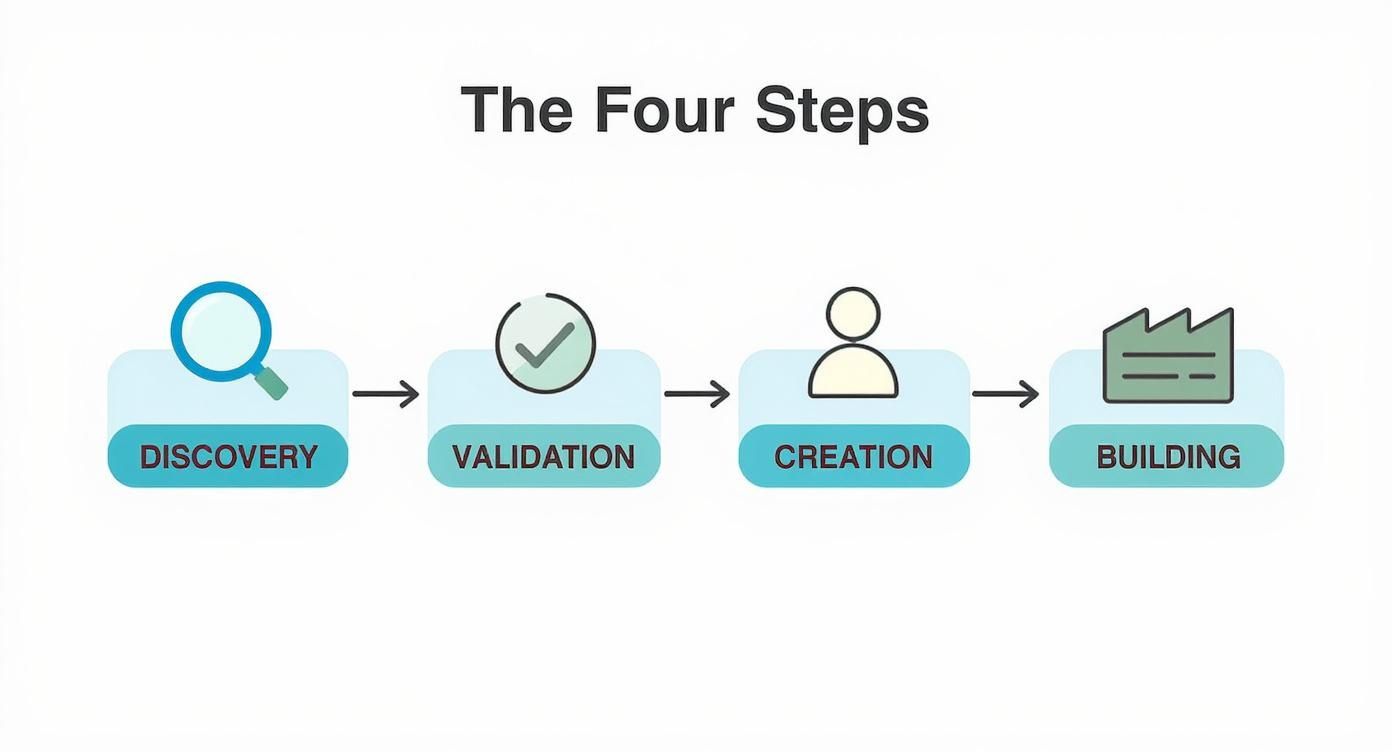

Instead of hiding away for months to build a product based on your own assumptions, Blank's model forces you to get out of the building. The core idea is simple: learn from real customers before you write a single line of code. The process is broken down into four clear stages: Customer Discovery, Customer Validation, Customer Creation, and Company Building.

From Idea to Empire: A Visual Roadmap

Why do so many startups fail? The reason is often simple: they build a product nobody actually needs. The entire purpose of the Four Steps framework is to stop you from becoming another statistic. It treats your business idea not as a fact, but as a series of guesses that need to be tested in the real world.

Think of it as a learning cycle, not a rigid plan. Each step gives you a chance to check your assumptions, get honest feedback, and make smart adjustments—or pivots—before you run out of money. The goal is to find a repeatable and scalable business model before you invest heavily in a sales team or big marketing campaigns.

This simple visual breaks down the journey, from the initial search for a problem to scaling a successful company.

As you can see, it’s a logical flow. You start by searching for a problem worth solving (Discovery) and end by building a company around a solution that customers will happily pay for (Building).

To give you a clearer picture, here’s a quick summary of what each step entails.

The Four Steps At A Glance

| Step | Your Main Goal | A Simple Example for a SaaS Founder |

|---|---|---|

| 1. Customer Discovery | Do people actually have the problem I think they have? | Interview 20 project managers to see if they struggle with tracking tasks across teams. |

| 2. Customer Validation | Can I build a solution people will actually pay for? | Get 3 of those project managers to sign up for a paid pilot of your early prototype. |

| 3. Customer Creation | How do I find more customers efficiently? | Run targeted LinkedIn ads to other project managers to drive sign-ups. |

| 4. Company Building | How do I scale from a startup to a real company? | Hire your first full-time salesperson and a dedicated marketing manager. |

This table shows how each phase builds on the last, moving from pure learning and searching to focused execution and growth.

The Foundation of Modern Startups

It’s hard to overstate how much this methodology has shaped the startup world. It laid the groundwork for the entire Lean Startup movement. Consider this: a staggering 42% of startups fail because there’s simply "no market need" for what they built. Blank's framework is a direct assault on that very problem. If you want to dig deeper, you can find more insights on why startups fail and how this process helps.

The core idea is captured perfectly in this famous quote:

> "A startup is a temporary organization designed to search for a repeatable and scalable business model." - Steve Blank

This gets to the heart of it all. Before you can build a lasting company, you have to find a business model that actually works. The early stages aren't about executing a grand vision; they're about searching for the truth in the market.

Step 1: Turning Assumptions Into Facts With Customer Discovery

So, you've got an idea. That’s the easy part. The first and most crucial step is where you stop guessing and start listening. This is Customer Discovery, and it's all about getting "out of the building" to test your big idea against reality.

Your business plan is just a list of guesses. Customer Discovery is the process of turning those guesses into facts. It's not about selling your product—in fact, you shouldn't have a product yet. It's about finding out if there’s a real, painful problem that people are desperate to solve.

Example: Imagine you want to build a SaaS tool for project managers. Your core guess, or hypothesis, might be: "Project managers at mid-sized tech companies struggle to track task dependencies across different departments."

Instead of locking yourself away to build a complex platform based on that hunch, your job is to get out there and try to prove that statement wrong.

From Hypothesis to Insight

Before you talk to anyone, write down what you think you know. These are your core hypotheses, which usually fall into three buckets:

- The Problem Hypothesis: Do project managers actually have this problem? Is it a "hair-on-fire" issue they'd pay to fix, or just a minor annoyance?

- The Customer Hypothesis: Who are these project managers? What are their daily jobs like? What pressures are they under?

- The Product Hypothesis: If I built a solution, would it actually solve their problem? What are the absolute must-have features?

With these questions as your guide, you can start the real work: customer interviews. This isn’t about sending out surveys; it’s about having deep, one-on-one conversations. Our guide on startup market research explains the difference clearly. Your goal is to get raw, unfiltered stories that reveal what customers truly need.

The payoff is huge. Founders who talk to customers are 56% more likely to find product-market fit. Plus, startups that pivot based on this direct feedback often raise 2.5 times more capital. This is solid proof of Blank's mantra: "the facts live outside the building." You can dig deeper into these numbers in this insightful summary of the book.

Crafting Questions That Uncover the Truth

The quality of your insights depends on the quality of your questions. You must avoid asking leading questions that just confirm what you already believe. Asking, "Wouldn't a tool that automatically tracks dependencies be amazing?" is useless. It only feeds your ego.

Instead, ask open-ended questions that encourage people to share their experiences.

> The goal of Customer Discovery is not to hear customers say they want your product. It’s to understand their world so well that you can build a solution they can’t live without.

Here’s a simple guide to reframing your questions, using our project manager SaaS example:

| Bad Questions (Leading & Vague) | Good Questions (Open-Ended & Specific) |

|---|---|

| Do you find it hard to manage tasks? | Can you walk me through how you managed your last big project, step by step? |

| Would you pay $50/month for our solution? | Tell me about the most frustrating part of tracking progress across teams. |

| Do you like our idea for a new dashboard? | How do you currently solve that problem? What tools or workarounds have you tried? |

By focusing on their past behaviors and current struggles, you get to the truth. If you find out the problem you thought was a big deal is actually a non-issue for them, that's not a failure. It’s a massive win. You just saved yourself months, maybe even years, of building something nobody wants.

Step 2: Finding A Repeatable Sales Model With Customer Validation

You’ve talked to potential customers and understand their problems. Great. Now for the moment of truth: will they actually pay for your solution?

This is Customer Validation, the second of the four steps to epiphany. It's where you prove your idea is more than just a "nice-to-have." Your goal isn't to make millions overnight. It's much simpler: find your first few paying customers and create a repeatable sales process.

Think of it as getting an engine to start for the first time. It might sputter, but if it runs, you have something real. Forget about big revenue targets for now; success is proving your sales process works. Getting those first checks is everything.

Building Your First Sales Roadmap

In this phase, you are creating your first "sales roadmap"—a step-by-step playbook for finding, pitching, and closing your first deals.

You'll go back to the same people you interviewed during discovery, but the conversation changes. Instead of just asking about their problems, you're now asking for their credit card.

You don't need a perfect product to do this. Your Minimum Viable Product (MVP) just needs to be good enough to show the value. It can be surprisingly simple.

Example MVPs for our project management tool:

A Clickable Prototype: Use a tool like Figma to build a mockup that feels* like a real product, without writing any code.

- A "Concierge" Service: Manually track dependencies for a few clients using spreadsheets and email. You deliver the promised value by hand, learning a ton in the process.

- A Compelling Slide Deck: A sharp presentation that clearly explains the problem, shows your solution, and details the expected results can be enough to get a commitment.

For our project management SaaS, this means going back to those frustrated managers you interviewed. You could show them a clickable prototype and ask them to sign up for a three-month paid pilot. That first signed contract is the strongest validation you can possibly get.

> Customer Validation isn't about selling a product; it's about selling a vision and getting early adopters to invest in it. A paying customer is the strongest signal that you’ve found a problem worth solving.

Measuring Success in Validation

Success at this stage isn't measured in massive revenue. It's measured in proof—hard evidence that you have a sales model you can repeat. You can learn more about these early-stage metrics by reading about what is market validation.

By the end of this stage, you should have clear answers to these questions:

- Can we find and connect with our target customers consistently?

- Does our pitch convince them to buy?

- How long does it take to close a deal, and what does that process look like?

- Content Marketing: Publish blog posts that solve their audience's biggest problems, like "How to Fix Cross-Departmental Blockers" or "The 5 Project Management Bottlenecks Killing Your Timeline."

- Targeted Ads: Run focused campaigns on LinkedIn, targeting users by job title ("Project Manager"), industry ("Computer Software"), and company size.

- Strategic Partnerships: Team up with other software companies that serve the same audience, or work with industry influencers who are trusted by project managers.

- Sales: This transforms from founder-led sales into a structured team with a VP, dedicated reps, and a well-defined sales process.

- Marketing: You'll stop experimenting randomly. Instead, you'll have a marketing leader and a real budget to scale the channels you've already proven to work.

- Engineering: The small team that built your MVP will expand into a larger organization focused on scalability, reliability, and a long-term technical vision.

- Product Management: This becomes a formal role, responsible for the product roadmap and making tough decisions based on the company's strategic goals.

- Discovery to Validation: You're ready when you have solid proof from interviews that your problem hypothesis is real. You need to hear directly from people that they genuinely feel the pain you're trying to solve.

- Validation to Creation: The green light here is a repeatable sales model. This means you’ve signed your first paying customers using a process you could write down and teach to someone else.

- Creation to Company Building: You get to this final stage when customer acquisition becomes predictable and scalable. You've figured out your marketing channels, your costs are manageable, and growth starts feeling less like luck and more like a formula.

If you can sell to a handful of customers using the same basic process, congratulations—you've validated your business model. If not, it's a signal to pivot. This feedback is priceless. Only move on to the next step after you’ve proven you have a sales model that works.

Step 3: It's Time to Scale with Customer Creation

You've done the hard work. You've proven a market exists for your product and you've found a repeatable way to sell it. Now, it's finally time to hit the accelerator.

This third stage, Customer Creation, is where everything shifts. Your focus moves from learning to aggressive scaling. You’re no longer asking if people will buy; you’re executing a plan to get in front of as many potential customers as possible.

This is the moment you confidently open the floodgates on your marketing and sales budget. Think of it as pouring fuel on a fire you already know is burning. The guesswork is gone, replaced by a calculated push to generate massive demand.

The goal is simple: scale customer acquisition. You're taking the successful sales roadmap you built during validation and injecting serious resources into it to grow your reach.

Where to Find Your Customers

Because you now know your ideal customer so well, you can be strategic about where you spend your money. The channels you choose will depend on your market, but your decisions are now backed by data, not just hunches.

Example for our project management SaaS: The team knows their target is project managers at mid-sized B2B tech companies. Their marketing efforts might look like this:

See the shift? You’re no longer testing random messages. You're amplifying a message you’ve already confirmed resonates with a specific group of people.

> In Customer Creation, you stop searching for a market and start executing a proven plan to conquer it. Every dollar you spend is a calculated investment in growth, not a blind gamble.

This is also where a tool like Proven SaaS becomes a powerful asset. Instead of guessing which marketing channels to try, you can see what’s already working for your competitors. This helps you enter the market with a strategy that’s already been field-tested, allowing you to skip months of painful trial and error.

The Big Mindset Shift: From Learning to Executing

The mental change in this stage is huge. For the first two steps, your main job was to learn. Now, it’s all about execution. Your key metrics evolve from qualitative feedback and a few pilot sign-ups to hard numbers like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and monthly recurring revenue (MRR).

This transition—from a learning-focused startup to a growth-focused machine—is the heart of Customer Creation. Nail this step, and you'll build the momentum needed for the final phase: Company Building.

Step 4: Building Your Company To Last

https://www.youtube.com/embed/IjS9eTpmhgk

So far, you’ve been searching for a business model that works. Now that you’ve found it, the real shift begins. Step 4: Company Building is where your scrappy startup, held together by sheer will, finally grows into a real organization built to last.

This is the phase where founders have to do something that feels unnatural: let go. You have to stop doing everything yourself and start hiring leaders who can do the job better than you. The company culture changes from a "search" mentality to a "mission" mentality. You're no longer looking for a path; you're on the path and need to start running.

Example: The founder of our project management SaaS is no longer making every sales call. Instead, they hire a VP of Sales who builds a team, sets quotas, and creates a predictable revenue machine. The chaotic "what should we build next?" approach is replaced by a formal product roadmap, overseen by a dedicated product manager.

From Searching To Executing

The core difference between a startup and a scaleup is what you focus on. In the early days, your goal is to learn. In the Company Building phase, your goal is to execute efficiently. This requires a total shift from informal chats and gut feelings to structured systems that can scale.

History is full of startups that found success but couldn't handle the growth. In fact, a staggering 70% of tech startups hit a wall when trying to scale. This is why The Four Steps to the Epiphany is so clear: don't build departments until you have a sales process that works over and over again.

Hiring too soon and spending big before you've found product-market fit is a classic mistake. It can lead to a 3.3x higher failure rate.

Let's look at the transition.

Startup Phase vs Scaleup Phase

This table breaks down the fundamental shift a company makes as it moves from the search stages (1-2) into the execution stages (3-4).

| Characteristic | Startup (Steps 1-2) | Scaleup (Steps 3-4) |

|---|---|---|

| Primary Goal | Learning and Discovery | Execution and Growth |

| Team Structure | Generalists (everyone does everything) | Specialists (defined roles and departments) |

| Key Metrics | Qualitative feedback, first sales | CAC, LTV, MRR, Churn |

| Processes | Informal and agile | Formal and scalable |

Getting this transition right is everything. If you don't build the right structure, the very growth you fought for can tear your company apart.

Building Your Functional Departments

As you enter this phase, you'll start to create formal departments with clear goals and accountability. This is a deliberate process.

Here are the key departments you'll need to build out:

Building these teams is about giving each department a clear mission that supports the company's overall vision. This is how you build a foundation strong enough to support incredible growth. As you grow, understanding how to value SaaS companies becomes critical, because a solid, scalable organization is a massive driver of that valuation.

Common Questions About The Four Steps

Diving into the Customer Development process can feel overwhelming at first. Even with a clear map like the four steps to epiphany, it's natural to have questions.

Let's clear up a few of the most common ones.

When Do I Move From One Step To The Next?

This is a big one. Remember that progress is about proof, not time. The most expensive mistake a founder can make is rushing to the next stage without solid evidence.

Each step has a specific, fact-based milestone you need to hit before you can move on.

Is This Framework Still Relevant For Modern SaaS Companies?

Absolutely. While the book has been around for a while, its core ideas are more important than ever. They form the foundation of modern approaches like the Lean Startup and Product-Led Growth.

Today's tools can speed things up, but they can't replace the need to "get out of the building" and talk to real users. The framework forces you to prove a market exists before you scale—a discipline that can save a software company from ruin.

> Market research tells you what is happening, but Customer Discovery tells you why. The "why" is where you find the insights that lead to breakthrough SaaS products.

How Is Customer Discovery Different From Market Research?

This is a great question, and the difference is crucial. They are related but serve different purposes.

Market research gives you the big-picture view. It's about understanding the market by looking at industry reports, surveys, and competitor data. For example, market research could tell you that the project management software market is growing by 12% a year. That’s useful, but it’s not specific.

Customer Discovery, on the other hand, is the ground-level view. It's about having direct conversations to understand a specific customer's frustrations. Customer Discovery is what reveals why a project manager is tearing their hair out over a clunky workflow that no existing tool gets right.

You need both, but discovery is where you find the deep, actionable insights that build amazing products.

---

Ready to stop guessing and find a SaaS idea with proven demand? At Proven SaaS, we analyze millions of ads to show you what's already working. See what competitors are successfully scaling and find your profitable niche today. Explore validated SaaS ideas now.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders