How to Find Product Market Fit for Your Startup

Product-market fit. It's the magic moment when you stop pushing your product onto people, and they start pulling it from you. It’s the difference between a cool idea and building an indispensable tool that a specific group of people can't live without.

Honestly, this is the single most important milestone for any startup. Nail this, and you've got a real shot. Get it wrong, and you're just burning cash.

So, What Does Product-Market Fit Actually Look Like?

Let's cut through the jargon. Product-market fit (PMF) isn't just a buzzword for pitch decks. The term, made famous by investor Marc Andreessen, perfectly captures the feeling when your startup finally clicks. It’s when you've built a product that solves a problem so well that customers don't just pay for it—they become your sales team.

Think of it like this: your product is the key, and the market is the lock. When they match, the door to growth swings open.

> "You can always feel when product/market fit isn't happening. The customers aren't quite getting value out of the product, word of mouth isn't spreading, usage isn't growing that fast... the sales cycle takes too long, and lots of deals never close." - Marc Andreessen

The Signals You've Found It

How do you know you're there? Trust me, you'll feel the shift. The constant uphill battle starts to feel more like you're riding a wave.

Here are the tell-tale signs:

- Effortless Growth: People start finding you on their own. Word-of-mouth becomes your best marketing channel.

- Sticky Customers: Your churn rate drops. Customers stick around because your tool is now embedded in their daily workflow.

- Faster Sales: Deals close quicker. The value is so obvious to the right people that the sales team isn't trying to force a fit.

Why It’s Everything for a Startup

Getting to product-market fit is the foundation of a healthy, scalable business. The stats are brutal: over 90% of startups fail. A huge reason is that they build something nobody truly needs. Nailing the alignment between your solution and a real-world problem is your best defense against becoming a statistic.

Example: Slack. They didn't start as the collaboration tool we know today. They were a gaming company whose game flopped. But they noticed the internal chat tool they built for themselves was incredibly useful.

They pivoted, focusing entirely on solving the messy problem of team communication. The market immediately recognized the value and pulled the product from them, sparking explosive growth. This kind of pivot doesn't happen by accident; it often starts with a deep competitive landscape analysis to spot where the real opportunities are hiding.

Pinpointing Your Customer and Their Problem

Before you write a single line of code, get one thing straight: who, exactly, are you building for? A vague idea like "small businesses" is a surefire way to build a product that helps no one in a meaningful way. The journey to product-market fit starts with an obsession—an obsession with a specific person and a specific, urgent problem they're desperate to solve.

You simply can't create something the market wants if you don't understand the market's pain first.

Moving Beyond Simple Demographics

Defining your Ideal Customer Profile (ICP) is about getting inside their head. It’s about the why behind what they do, not just the what.

- What drives them? Are they under pressure to grow revenue, save time, or avoid a critical risk?

- What does a "good day" at work look like? Understand their workflow and where the frustrating bottlenecks are.

- What tools do they already use? This tells you what they value and what they’re already willing to pay for.

This level of detail helps you zero in on a high-value problem—a pain point so sharp that your target customer is already actively looking for a solution. Learning how to find profitable niches is almost always a direct result of this kind of deep customer dive.

Uncovering Genuine Pain Points

The best way to know if a problem is real is to talk to the people who have it. Customer interviews aren't sales pitches; they're fact-finding missions. Your only job is to listen and learn.

> The biggest mistake a founder can make is falling in love with their solution before they've fallen in love with their customer's problem.

Failing to grasp the customer's real-world struggle is a classic startup killer. Around 34% of startups fail because they build something nobody needs.

Example: Google Glass. It was a technical masterpiece that solved a problem very few people actually had, made worse by privacy issues and a steep price.

The image below shows Google Glass in action, a perfect example of incredible technology that couldn't find its market.

It’s a stark reminder that innovation alone isn’t enough. Your goal is to find a "hair on fire" problem—a problem so painful that if you showed up with a bucket of water, your ideal customer would eagerly throw money at you. That's the foundation of a successful product.

Building Your First Real Product

You’ve done the research and you know your customer's biggest problem. Now it's time to build. But this isn't about creating the grand, feature-packed product you've been dreaming of. Not yet. The goal right now is speed and learning, and that starts with your Minimum Viable Product (MVP).

An MVP is the most stripped-down version of your product that can still solve that one core problem for your first users. Its job is to test your biggest assumption with the least amount of wasted effort. Think of it as a focused experiment.

Get Brutal About Prioritizing Features

The hardest part of building an MVP is fighting the urge to add "just one more thing." Your mission is to pinpoint the one essential function that solves the specific pain point you’ve uncovered and build only that.

For every feature on your wishlist, ask this simple question: "Can my first customer solve their main problem without this?" If the answer is yes, it gets cut.

Example: Dropbox. Their vision was complex file-syncing. But their MVP was just a video. The video simply showed how the product would work, letting them collect email sign-ups and validate demand before a single line of difficult code was written. They proved people wanted what they were selling before they actually built it.

> Your MVP isn't a smaller, cheaper version of your final product. It's a learning machine. Its only purpose is to prove your core idea as quickly and cheaply as possible.

This mindset saves you months of development time and puts you on the fast track to finding product-market fit.

Create a Feedback Loop You Can’t Ignore

An MVP is useless without a way to learn from it. From day one, you need a system for capturing insights from your early adopters. This kickstarts the essential cycle of building, measuring, and learning.

Your feedback system needs to capture both the "what" and the "why."

Quantitative Data (The "What"): This is hard data showing what people are actually* doing in your product. Basic analytics will show you which features get used and if they're coming back.

- Qualitative Insights (The "Why"): This is where you get the stories and frustrations directly from users. Keep it simple: set up a feedback form or—even better—get on 15-minute video calls with them.

You need both. Your data might show 70% of users abandon signup at a specific step. But only by talking to a user will you learn it's because a button is confusing. This combination of numbers and stories is what turns an MVP into a growth engine.

Measuring Your Progress Toward Product Market Fit

Product-market fit isn't a destination you suddenly arrive at. It’s a subtle shift, and if you’re not tracking the right signals, you can miss it. The only way to know if your product tweaks are working is to measure their impact.

The key is to blend different types of data. You have leading indicators (early hints like user engagement) and lagging indicators (like retention rates) which confirm you're delivering lasting value.

The Hard Numbers: What Your Users Are Actually Doing

Before you ask anyone what they think, get a clear picture of what they're doing. A focused analytics dashboard is your best friend.

Here’s what to keep an eye on:

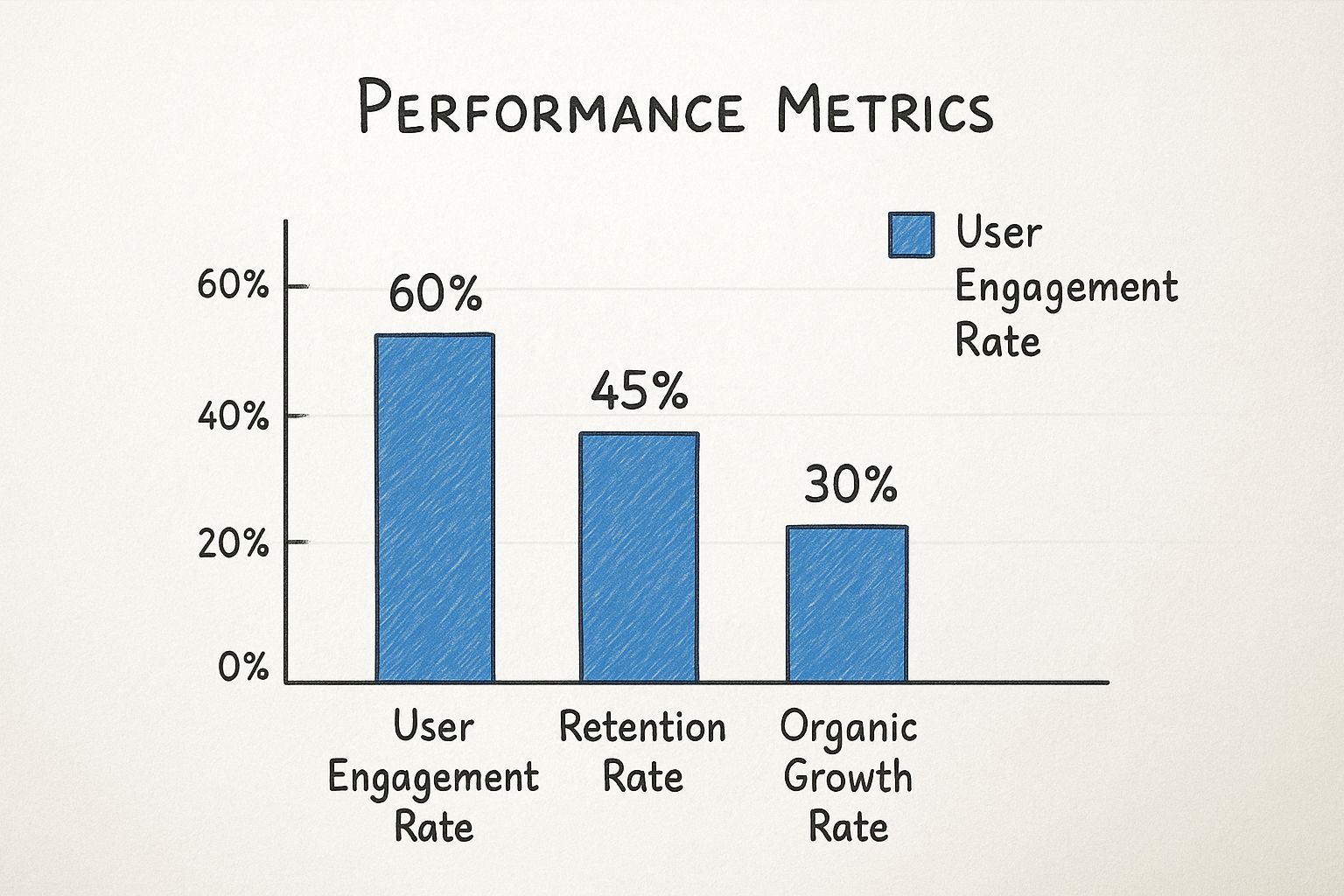

- User Engagement: Are people actually using your core features? When you see consistent, active use, it means your tool is becoming part of their routine.

- Customer Retention: This is the big one. If your customers stick around month after month, you’ve built something they can't easily live without. Low churn is the strongest indicator of PMF.

- Organic Growth: You know you've built something special when your customers start doing your marketing for you. A growing number of sign-ups from word-of-mouth or referrals is a powerful sign of market pull.

This is the trifecta: strong engagement leads to high retention, which sparks organic growth.

The infographic above gives you a great visual for how this works—each metric builds on the last, creating a powerful growth engine.

Key Metrics for Measuring Product Market Fit

This table organizes the essential quantitative and qualitative signals that show you're on the right path.

| Metric Category | Specific Metric | What It Tells You |

|---|---|---|

| User Engagement | Core Feature Adoption Rate | Are users discovering and using the features that deliver your core value proposition? |

| Daily/Monthly Active Users (DAU/MAU Ratio) | How "sticky" is your product? A high ratio indicates frequent, habitual use. | |

| Customer Retention | Churn Rate | What percentage of customers are you losing over a given period? The lower, the better. |

| Net Promoter Score (NPS) | How likely are users to recommend your product to others? A strong signal of customer loyalty. | |

| Growth & Revenue | Customer Lifetime Value (LTV) | How much revenue you can expect from a single customer account. Healthy PMF leads to a high LTV. |

| Organic vs. Paid User Acquisition | Are new users finding you on their own (word-of-mouth, direct)? This signals true market pull. | |

| Qualitative Signal | The Sean Ellis Test ("Disappointment Score") | Would your users be very disappointed if they could no longer use your product? (More on this below). |

Monitoring these metrics together provides a holistic view. You can dig deeper into the most important product market fit metrics on GapScout.com to get an even more granular understanding.

The "Why" Behind the Numbers: Qualitative Feedback

Data tells you what is happening, but it rarely tells you why. That's where talking to your users comes in.

One of the most powerful ways to do this is with the Sean Ellis Test, pioneered by the growth hacker who helped Dropbox.

> The test is incredibly simple. Just ask your users one question: "How would you feel if you could no longer use this product?"

The magic number is 40%. If at least 40% of respondents say they'd be "very disappointed," you have a strong signal of product-market fit. If your score is lower, your product is still a "nice-to-have," not a "must-have." Now you know it’s time to find out why.

Example: Superhuman. The email client famously used this exact method. They didn't just look at the overall score. They isolated the users who answered "very disappointed" and focused all their energy on understanding what those people loved. By doubling down on what resonated with their most passionate users, they sharpened their product and accelerated their path to PMF.

Knowing When to Tweak and When to Overhaul

Let's be honest: the road to product-market fit is never a straight line. It’s a messy path of listening, learning, and course-correcting. This is the stage where you take raw customer feedback and turn it into a better product.

Your job is to filter the signal from the noise. Focus on the insights that come from your Ideal Customer Profile (ICP). A feature request from a power user who is your target customer is worth ten times more than a complaint from someone who was never going to be a good fit.

This isn't about just building what people ask for. It's about spotting patterns. When you hear the same frustration from several of your best customers, that’s not just a suggestion—that’s a roadmap.

Iterate or Pivot? That's the Million-Dollar Question

Most of your time will be spent iterating. These are small, deliberate adjustments—fixing bugs, smoothing out a clunky user flow, or adding a small feature that makes your product stickier. It's all about optimization.

But sometimes, a tune-up isn't enough. Sometimes you need a new engine. That’s a pivot.

A pivot isn't just changing a feature; it's a fundamental shift in your strategy. You're changing your target market or core value proposition because the data shows your original idea was wrong.

Deciding to pivot is one of the hardest calls a founder has to make. What are the red flags?

- Your Metrics Have Flatlined: No matter what you tweak, your engagement and retention numbers aren't moving.

- The "Meh" Response: Users say they wouldn't be "very disappointed" if your product vanished. You’re a nice-to-have.

- You Stumble on a Bigger Problem: Customer conversations uncover a far more painful problem that your team is perfectly equipped to solve.

> A pivot feels like admitting you were wrong. But it’s also a strategic bet on a new path. It takes guts to let go of your original vision and follow where the market is leading you.

A Masterclass in Pivoting: The Instagram Story

Look no further than the legendary pivot of Instagram. It didn't start as the photo-sharing giant we know today. It was originally a clunky, location-based social network called Burbn.

The app tried to do too much. But the founders noticed something in their data. While people ignored most of Burbn's features, they were obsessed with one thing: sharing photos and applying filters.

They made a bold call: they stripped away everything except the photo-sharing part. They pivoted from a bloated network to an app that did one thing flawlessly.

The result? The new app, Instagram, hit 1 million users in just two months. Their story teaches a critical lesson: sometimes, the fastest way to product-market fit is by doing less, not more.

Common Questions About Product-Market Fit

The path to product-market fit is rarely a straight line. Let's tackle some common questions.

How Long Does It Take to Find Product-Market Fit?

There's no magic number. For many SaaS startups, this can take anywhere from six months to two years. It depends on your industry, product complexity, and how quickly your target customers adopt new tools.

Forget the calendar. Watch your metrics. Are retention numbers creeping up? Is word-of-mouth becoming a real source of new users? Focus on these small wins—they're a much better indicator of progress than a deadline.

Can You Lose Product-Market Fit After Finding It?

Absolutely. Product-market fit isn't a trophy you put on a shelf; it's a living thing you have to nurture. Markets are constantly shifting—new competitors appear, technology evolves, and your customers' needs change.

Look at BlackBerry or MySpace. They were once untouchable but failed to keep up as the world changed. The lesson: staying obsessed with your customers and constantly iterating isn't just a good practice, it's essential for survival.

> Product-market fit is not a one-time achievement. It's a continuous process of aligning your product with an ever-changing market. The moment you stop listening is the moment you start losing it.

What’s the Difference Between a Good Idea and PMF?

A good idea is the spark—your starting hypothesis. Product-market fit is that hypothesis getting a massive stamp of approval from the market itself. Countless failed startups were built on clever ideas that didn't find an audience willing to pay.

A "good idea" solves a problem on a whiteboard. Product-market fit means you've successfully aligned three things:

- The right solution

- For the right audience

- With the right business model

That combination turns an idea into a real, sustainable business. We talk more about this journey on the Proven SaaS blog.

Should I Focus on Growth or Product-Market Fit First?

Product-market fit. First. Always.

Trying to scale before you have PMF is like pouring water into a leaky bucket. You can spend a fortune on ads to get new users, but if the product doesn't deliver on its promise, they won't stick around. You'll just end up with sky-high churn.

Once you have solid proof of PMF—high retention, great NPS scores, and customers referring their friends—that's the green light. That’s when you invest in growth, knowing the new users you bring in will actually find value and stay.

---

Ready to stop guessing and start building with confidence? Proven SaaS uses advertising intelligence to uncover profitable SaaS ideas where competitors are already spending thousands on ads—a clear signal of market demand. Find your next validated niche today. Explore Proven SaaS.

Article created using Outrank

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders