How to Find Profitable Niches That Actually Work

Finding a profitable niche boils down to one simple concept: identifying a specific group of people with a painful problem they’re already trying to solve with their wallets. It’s not about discovering a magical, competitor-free market. It's about finding a genuine, unmet need and serving it better than anyone else.

What Really Makes a Niche Profitable

Before brainstorming, you need to understand what separates a real business opportunity from a passing trend. Many founders focus on their own passions or chase the myth of zero competition, but profitability is built on a much more solid foundation. The goal is to filter out weak ideas from the start by focusing on a few core principles.

A profitable niche isn't just an interesting idea; it's a group of people desperate for a solution. Think of it this way: a hobby is something people enjoy, but a problem is something people will pay to make disappear. That distinction is everything when you're looking for a niche that can actually support a business.

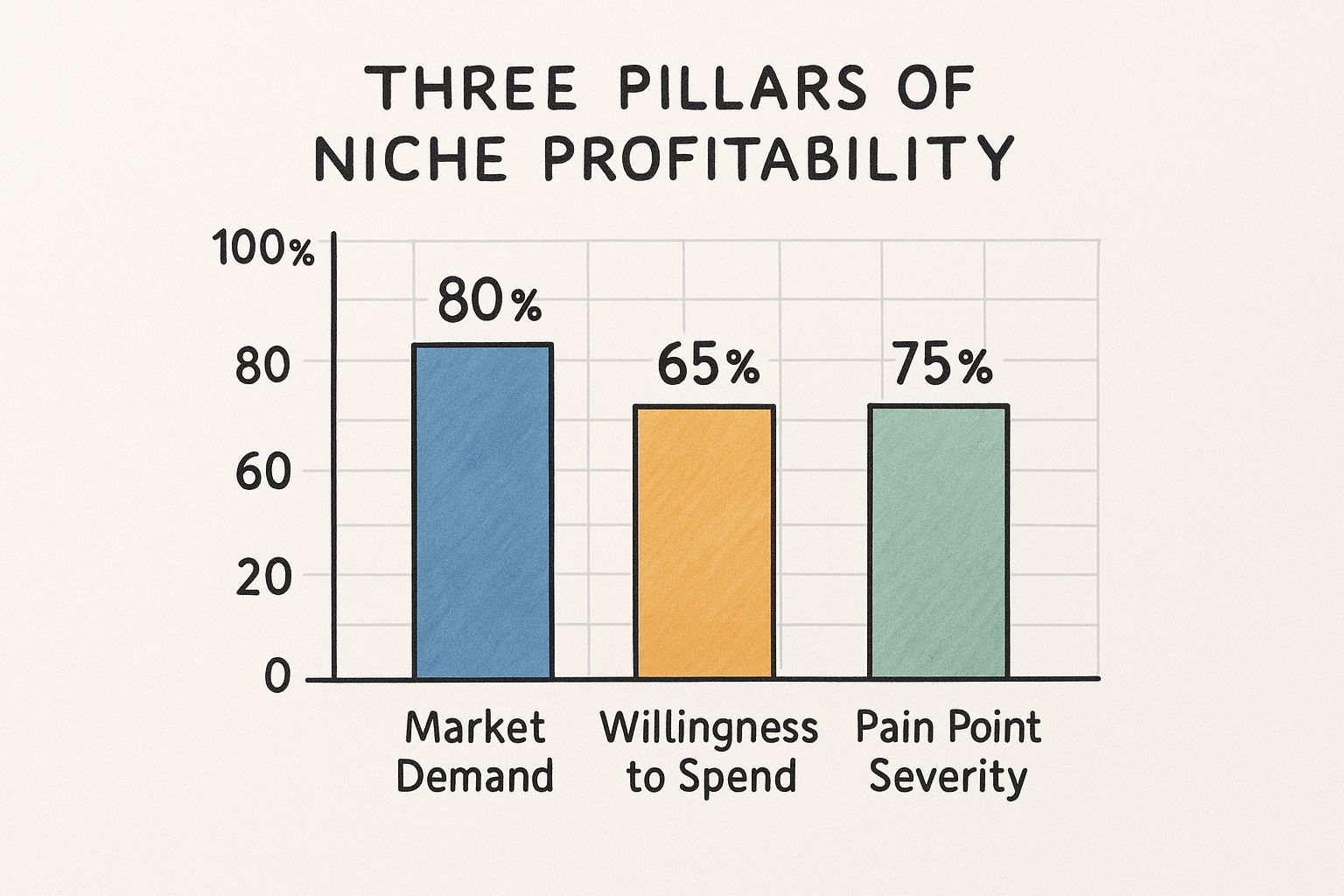

The Three Pillars of a Strong Niche

For an idea to have real potential, it needs to stand on three key pillars: market demand, a willingness to spend, and a severe pain point. If you miss even one of these, you’re setting yourself up for a long, difficult journey.

Here’s a clear breakdown of what to look for:

Genuine Market Demand: Is there a sizable group of people actively* searching for a solution? You’re not trying to create demand from scratch; you’re tapping into a need that already exists.

Willingness to Spend: It’s not enough for your audience to want* a solution—they must be willing and able to pay for it. Some audiences are conditioned to look for free tools, while others will gladly pay for something that saves them time, makes them money, or removes a major headache.

- A Clear, Solvable Pain Point: The problem must be specific and painful enough that they’re desperate for a dedicated fix. Vague, "nice-to-have" features are hard to build a product around and even harder to sell.

This simple visual shows how these three pillars work together to signal a niche's potential.

As you can see, even if one area like "willingness to spend" isn't perfect, a strong combination of high market demand and a severe pain point can still signal a fantastic opportunity.

Real-World Examples in Action

Let's look at how this plays out with real businesses. Consider the rise of specialty coffee subscriptions. The market demand was already there—people love great coffee. The pain point was the inconvenience of finding new, high-quality beans and the limited variety at local stores. The audience demonstrated a willingness to spend for a premium, curated experience delivered to their door.

Another excellent example is ergonomic home office furniture. The sudden shift to remote work created a massive pain point for millions: back pain from poor posture. This sparked huge market demand from an audience that was more than willing to spend hundreds of dollars on chairs and desks that solved that specific problem.

> By focusing on these three things—demand, budget, and pain—you stop guessing what might work and start identifying what the market is already asking for. This framework is your most valuable filter.

Using Data to Uncover Hidden Niche Ideas

This is where you move past assumptions and start listening to what people are actually saying. The internet is a massive, living focus group, and you just need to know where to look. By tuning into real conversations, you can uncover raw, untapped ideas that already have a built-in audience waiting for a solution.

Think of yourself as a digital detective. Your mission is to find clues hidden in plain sight—the online complaints, questions, and discussions that all point to a painful, unsolved problem. The best part? You don’t need expensive software, just a healthy dose of curiosity.

Tune Into Online Communities

Online forums and social media are goldmines for this research. People are remarkably open about their frustrations online, which gives you a direct window into the problems that keep them up at night.

Start with communities built around industries or professions you find interesting.

- Reddit: Explore subreddits like `r/smallbusiness` or `r/freelance`. You’ll quickly find people describing their daily operational headaches—from messy inventory systems to clunky client reporting tools. These are problems people would happily pay to solve.

- Quora: Search for questions starting with "How do I..." or "What's the best tool for..." in a specific field. The questions with the most views and answers signal a common, persistent problem.

- Facebook Groups: Join groups for specific professionals, like "Virtual Assistants" or "Podcast Editors." These are filled with members venting about software that doesn’t meet their needs and wishing for features that don't exist yet.

Here’s a practical example. Imagine you’re browsing `r/etsysellers` and notice a recurring complaint: sellers are struggling to calculate shipping costs for international orders accurately. That’s not just a random comment; it’s a data point. It’s a signal that a specific market gap exists, one that a targeted tool could fill.

> The most powerful niche ideas almost always come from listening to real people talk about their real problems. When you see the same frustration appearing repeatedly across different platforms, you’ve likely found something valuable.

Dig Into Search Trends and Data

Listening to communities gives you qualitative insight (the "what"). Tools like Google Trends provide quantitative proof (the "how many"). This free tool is excellent for seeing how interest in a topic changes over time, allowing you to spot a rising trend before it becomes mainstream.

Let’s say you’re interested in the wellness space. It’s a massive market, valued globally at a staggering $4.5 trillion. There are tons of opportunities hiding within it. If you want to explore more profitable markets, Gelato's blog offers some great insights.

However, "wellness" is too broad. You need to get specific. Instead of a generic search, try comparing more niche terms like "gut health supplements" versus "personalized vitamins." You might find one trend is fading while the other is steadily climbing, giving you a clear signal of where consumer interest is heading.

This data-driven approach removes emotion from the process and helps you focus on niches with actual, measurable momentum.

While Google Trends is a great starting point, several other tools can give you a more complete picture. Some are free, while others offer more advanced features for a price.

Niche Discovery Tool Comparison

| Tool | Primary Use | Key Feature | Cost |

|---|---|---|---|

| Google Trends | Analyzing search interest over time | Compares the relative popularity of multiple search terms | Free |

| AnswerThePublic | Visualizing search questions | Creates mind maps of questions people ask around a keyword | Freemium |

| Exploding Topics | Identifying emerging trends | Surfaces fast-growing topics before they become mainstream | Freemium |

| Ahrefs | SEO and keyword research | Shows keyword search volume, difficulty, and related terms | Paid |

Each of these tools offers a different lens through which to view potential niches. Combining insights from community listening with hard data from these platforms is the most reliable way to build a strong foundation for your business.

How to Analyze Competitors and Find Your Angle

If you've identified a niche and found competitors, that’s a great sign. It means there’s an active, paying market for what you want to build. Your goal isn't to find an empty field; it's to carve out your own unique space in a field that's already proven to be fertile.

Think of competitors as free market research. They’ve already spent the time and money to attract an audience and prove a problem exists. Now it’s your turn to figure out where they're falling short.

Dissect Their Offerings to Find Weaknesses

The best way to start is by getting hands-on. Sign up for their free trials. Read their marketing copy. Use the product and map out its core features. You’re looking for what they do well, but more importantly, where their weaknesses lie.

Pay close attention to who their product is really for. Is a competitor laser-focused on huge enterprise clients? That could leave a wide-open opportunity for a simpler, more affordable tool built for freelancers or small businesses.

Look at the project management space. It’s packed with giants like Asana and Jira. Yet, Trello found massive success. How? They didn't try to out-feature the competition. Instead, they built a dead-simple, visual tool that appealed to individuals and small teams who were overwhelmed by the complexity of the bigger platforms. They didn't create a new market; they just served an existing one better.

Mine Customer Reviews for Hidden Opportunities

Customer reviews are a goldmine. Head over to sites like G2 or Capterra and start digging. This is where you get unfiltered, honest feedback from people who are using these products every day.

Look for patterns in the complaints.

- Are people constantly requesting a specific feature?

- Do they find the user interface clunky and confusing?

- Is customer support notoriously slow or unhelpful?

Every one of these complaints is a potential opening for you.

> A three-star review is often more valuable than a five-star one. It highlights a customer who wanted to love the product but was let down by a specific flaw—a flaw you can solve.

For example, imagine you're exploring the email marketing niche. You find a popular tool, but on review sites, you see dozens of e-commerce store owners complaining that its segmentation features are too basic for their needs.

That's your angle. You could build a competing tool that specializes in advanced, e-commerce-specific segmentation, positioning it as the go-to solution for online stores. This is how you find a defensible spot in an already crowded market.

Testing Your Niche Idea Without Breaking the Bank

An idea on paper is just an idea. What separates a successful business from a forgotten project is validation. Before you write a single line of code or spend a dollar on development, you must find out if real people will actually pay for your solution.

This phase is all about collecting evidence. Your passion is important, but it won't pay the bills. You need to make data-driven decisions to avoid wasting time and money on a product nobody wants. The good news? Testing the waters doesn’t require a huge budget.

Launch a Simple Validation Landing Page

One of the fastest and cheapest ways to gauge interest is to run a "smoke test" with a simple landing page. This is a single webpage that clearly explains what your product does and the main benefit it offers. The goal isn't to sell anything yet; it's to see how many people are interested enough to provide their email address.

You can create one in an afternoon using a tool like Carrd or Unbounce. Just make sure it includes these key elements:

- A Killer Headline: Get straight to the point. Example: "The Easiest Way for Freelancers to Track Billable Hours."

- A Clear Value Proposition: Quickly explain who it's for and how it solves their problem. No jargon.

- A Single Call-to-Action (CTA): A button that says "Get Early Access" or "Join the Waitlist" leading to an email signup form.

Once your page is live, drive some traffic to it. Share it in relevant online communities (without being spammy!) or run a small, targeted ad campaign. The number of email signups is your direct measure of interest. If 10% or more of your visitors sign up, you're likely onto something promising.

Use Micro-Ad Campaigns to Test Messaging

Another effective technique is to run small ad campaigns on platforms like Facebook or LinkedIn. You don't need a massive budget; even $50-$100 can provide a wealth of valuable data.

Create a few different ad variations, each with a unique angle or message, targeting your ideal customer. Then, see which one gets the most clicks.

You're not aiming for sales here; you're learning. Watch metrics like click-through rate (CTR) and cost per click (CPC). A high CTR on a specific message indicates that you've struck a nerve. This helps you figure out how to talk about your solution, which is just as important as what it does.

> Think of this as market research that practically pays for itself. By finding a message that resonates, you're not just validating your idea—you're building the foundation for all your future marketing.

The Power of the Presale

For the ultimate form of validation, try preselling your product. This involves asking people to pay for your solution before it's fully built, typically by offering a significant early-bird discount. There is no clearer signal that you’ve found a profitable niche than people voting with their wallets.

This model works especially well today. People are more comfortable with subscriptions than ever—the market is projected to hit $1.5 trillion by 2026, thanks to their convenience. This trend, highlighted in this article about the growth of trending niches on Ecomposer's blog, makes customers much more receptive to early-access deals.

By using these low-cost validation techniques, you can gather undeniable proof that your idea has potential. This evidence-based approach removes the guesswork, giving you the confidence to move forward and invest your resources wisely.

Choosing Your Niche and Planning Your First Moves

You’ve done the research, analyzed the competition, and tested your assumptions. Now it's time to make a decision. This is where all that work transforms into a real business plan.

It’s easy to get stuck in "analysis paralysis" here. To cut through the noise, use a simple scoring system to evaluate your best options honestly.

Making the Final Niche Decision

Take your top three ideas and rank each one on a scale of 1 to 5 across these key areas. This quick exercise will help your best option stand out.

- Profit Potential: How strong is the evidence of demand? Did your validation tests show that people are willing to pay? A 5 means you have hard evidence, like a list of pre-orders or a high-converting waitlist.

- Personal Interest: Be honest. Can you see yourself obsessed with this niche for the next 2-3 years? A 5 means you’re genuinely excited to solve this problem and connect with these customers.

- Market Entry Difficulty: How hard will it be to get your first customers? Consider the existing competitors and the complexity of your solution. A 5 means you've found a clear, underserved segment of the market you can target from day one.

Add up the scores. The winner isn't always the one with the highest number, but it’s usually the one with the most balanced profile—a solid mix of profit signals, personal passion, and a clear path to market.

> Choosing your niche is a commitment. It's the foundation for your product, marketing, and brand. Using a simple framework like this ensures your decision is based on both data and gut instinct.

Outlining Your First Moves

With your niche selected, it's time to build momentum. Forget about writing a 50-page business plan. Instead, map out a few immediate, high-impact steps to get started.

First, define your unique selling proposition (USP). What is the one thing you’ll do better than anyone else for your specific customer? For example, if you're building project management software for solo designers, your USP could be: "The simplest way for freelance designers to manage clients and get paid on time." It’s specific, clear, and benefit-focused.

Next, scope out your minimum viable product (MVP). An MVP isn't a buggy, incomplete version of your final vision. It's the simplest, most elegant solution that solves the core problem for your first users. The goal is to get something functional into their hands quickly so you can start learning from their feedback.

Finally, sketch out a simple content plan. You don't need a six-month calendar. Just outline 3 to 5 blog posts or social media updates that address the biggest pain points your audience has. This early content will act as a magnet for your ideal first customers and help you start building a community before you've even written a line of code.

Got Questions About Finding Your Niche?

Even with a solid plan, questions will come up as you search for the perfect niche. Let's tackle some of the most common hurdles so you can keep moving forward with confidence.

How Saturated Is Too Saturated?

It's easy to look at a market with a dozen competitors and think, "I'm too late." But saturation isn't about the number of players; it's about the quality of their solutions.

A market might look crowded, but upon closer inspection, you may find that existing tools are clunky, customer support is poor, or the reviews are mediocre. That's not a dead end; that's a massive opportunity.

Don't let competition scare you. Instead, look for the gaps. Can you serve a specific slice of that audience better than anyone else?

Take the coffee market—it's incredibly saturated. But what about a niche like mushroom coffee blends specifically for cognitive performance? Suddenly, you're not competing with everyone. You’re targeting a small, passionate group that the big brands are overlooking.

> Competitors aren't a red flag. They're proof that people are already spending money in this space. Your goal isn't to find an empty field—it's to find a better angle in a proven market.

Should I Follow My Passion or the Profit?

This is the classic dilemma. The honest answer is that you need a bit of both.

Chasing a passion with no paying customers is a great way to build a hobby, not a business. If no one is willing to pay for what you offer, it will remain a side project.

On the other hand, pursuing a profitable idea that you find boring is a recipe for burnout. You'll dread working on it, your marketing will feel inauthentic, and customers will sense your lack of enthusiasm.

Here’s a practical approach: Start with the data. Identify a handful of profitable ideas first. Then, from that pre-vetted list, choose the one that genuinely excites you. That excitement is what will carry you through the tough days and help you build a real connection with your audience.

When Is It Time to Stop Researching and Start Building?

You're researching to make an informed decision, not to find a risk-free guarantee—that doesn't exist. It’s easy to get stuck in "analysis paralysis," spending months refining a plan without taking action.

The most valuable lessons don't come from spreadsheets; they come from interacting with actual customers.

For most people, a focused sprint of two to four weeks is plenty of time for initial research. This gives you enough time to spot promising ideas, analyze competitors, and run a simple validation test, like a landing page or a small ad campaign.

It's far better to launch a small test and get immediate market feedback than to spend six months perfecting a business plan that has never been tested in the real world. The faster you get data, the faster you can learn what people actually want to buy.

---

Stop guessing and start building with confidence. Proven SaaS uses AI-powered intelligence to analyze millions of ads, uncovering validated SaaS niches where competitors are already spending big money—a clear signal of a profitable market. Find your next great idea today at Proven SaaS.

Article created using Outrank

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders