A Founder's Guide to Competitive Landscape Analysis

Think of a competitive landscape analysis as your business’s GPS. It doesn't just show you where you are; it maps the whole terrain, showing other drivers, roadblocks, and shortcuts. This isn't just about listing your rivals. It’s a deep, strategic look at their products, strategies, strengths, and—most importantly—their weaknesses. For a SaaS founder, this is the map you need to find a unique path to success.

What Is Competitive Landscape Analysis

Imagine you want to open a coffee shop. You wouldn’t just set up on any street corner. You’d walk the neighborhood, visit other cafés, see who their customers are, what they charge for a latte, and what makes their place special. A competitive landscape analysis is that same scouting mission, but for your SaaS business.

It’s a structured way to identify and size up every player in your market—not just the direct competitors who look and act like you. It's a full review of their market share, marketing tactics, what their customers say online, and every feature in their product.

More Than Just a Competitor List

One of the biggest mistakes founders make is thinking this is just a list of other companies. A real analysis is a living snapshot of your market. It gives you a rich, textured understanding of where you fit in and provides the foundation for smart decisions.

> The purpose of a competitive landscape analysis is to support leadership’s decision-making. It’s not just about understanding strengths and weaknesses—it’s about charting a course and ensuring you aren’t overtaken by a threat you didn’t see coming.

Getting this comprehensive view helps you do a few critical things:

- Spot Market Gaps: Find customer problems your competitors are ignoring. For example, if all competitors focus on large enterprises, there might be a huge opportunity to serve small businesses.

- Sharpen Your Strategy: Figure out what makes you different and how to communicate it.

- See Threats Coming: Keep an eye on new players or tech shifts before they blindside you.

- Inform Your Roadmap: Give your team the data they need to build a product that can win.

Why It Matters for SaaS Founders

For a SaaS company, this isn't a "nice-to-have"—it's essential. The cost to launch a software product has dropped, meaning your next competitor could appear tomorrow. Without a clear picture of the landscape, you risk building a "me-too" product that gets lost in a sea of sameness.

A solid analysis gives you the clarity to carve out a space you can own. It forces you to answer the tough questions: "Where are my rivals weak?" and "What specific problem can I solve better than anyone else?" By starting with this map, you build your company on a foundation of real market insight.

How to Identify Your Key Competitors

Before you analyze the competitive landscape, you need a clear map of who’s on it. A common mistake is thinking every company in your space is a true rival. The first step in any solid competitive landscape analysis is figuring out who is really competing for your customers' attention and budget.

Thinking about competitors in different categories is the best way to get this right. It forces you to look at the market from all angles, so you don't get blindsided.

Direct Competitors

These are the obvious ones. Direct competitors offer a similar product to the same customer, solving the same problem. They're the companies your prospects are likely comparing you to feature-for-feature.

Example: In the project management space, Asana and monday.com are direct competitors. They have similar features, target similar teams, and show up together in Google searches and on review sites.

Indirect Competitors

This is where it gets trickier. Indirect competitors solve the same core problem you do, but with a different approach or product. They aren’t a one-to-one alternative, which is why many founders overlook them.

Example: For a project management tool like Trello, an indirect competitor is a simple spreadsheet. A team can easily track tasks in Google Sheets. The spreadsheet is still solving the underlying problem—“how do we organize this project?”—making it a very real indirect competitor.

> It's crucial to spot these indirect players. They show you all the different ways customers are already solving their problems, which can be a goldmine for new feature ideas or a fresh marketing message.

Emerging Competitors

Finally, you have emerging competitors. These are companies that aren't direct rivals today but could easily become one tomorrow. They might operate in an adjacent market or have a product that could be adapted to do what you do.

Example: Imagine a company with a large CRM platform. Right now, they don't compete with your specialized email marketing tool. But what if they add an "email marketing" module next quarter? Suddenly, they're a powerful direct competitor with a huge existing user base.

The smartphone industry shows how this works. You have direct competitors like Apple and Samsung, but they also face threats from substitutes like tablets or powerful laptops (indirect competitors), which influences their decisions. For a deeper dive, check out this breakdown of competitive forces in the tech industry on papermark.com.

Here's a simple table to help you spot each type.

Types of Competitors and How to Spot Them

| Competitor Type | Definition | SaaS Example | Key Question to Ask |

|---|---|---|---|

| Direct | Offers a similar product to the same target audience to solve the same problem. | Asana vs. monday.com (Project Management) | "If we didn't exist, which product would our customers buy instead?" |

| Indirect | Solves the same core problem but with a completely different type of solution or product. | Trello vs. Google Sheets (Task Tracking) | "What other tools or methods are customers using to get this job done?" |

| Emerging | A company that isn't a direct competitor now but could easily pivot to become one. | A broad CRM adding a specialized email marketing feature. | "Who serves an adjacent market or could add our core feature with little effort?" |

Thinking through these categories helps you build a complete picture, ensuring your strategy is based on the reality of the market.

Using Frameworks to Structure Your Analysis

Digging up data on your competitors is one thing; making sense of it is another. Without a solid structure, you can drown in facts and figures. Frameworks act as a sorting system, turning raw data into a clear map that guides your strategy.

Frameworks give you a proven, step-by-step way to run a competitive landscape analysis. Instead of getting lost in a messy spreadsheet, you can slot your findings into a model built to spot patterns, flag risks, and surface opportunities.

For SaaS founders, two of the most effective frameworks are SWOT Analysis and Porter's Five Forces. They’re popular because they're simple yet powerful. Let's see how a startup can use them.

Applying a SWOT Analysis

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It’s a simple four-quadrant grid that helps you size up a competitor. Strengths and Weaknesses are internal factors about the competitor, while Opportunities and Threats are external factors from the broader market.

Example: Imagine you're a new project management tool analyzing a big, established competitor.

- Strengths: They have a household name and a massive user base.

- Weaknesses: Their user interface is outdated and slow. Customers complain about it.

- Opportunities: The market is shifting toward tools built for remote teams—a niche the big competitor isn't serving well.

- Threats: New, agile startups are emerging with lower prices and better technology.

Laying it out like this reveals a path forward. Their weakness (clunky UI) combined with a market opportunity (demand from remote teams) points to a perfect gap you can target.

Using Porter's Five Forces

While SWOT is great for a deep-dive on one company, Porter's Five Forces gives you a 30,000-foot view of your entire industry. It helps you understand all the pressures that define your market's profitability.

> This framework zooms out to analyze five key forces that shape your competitive environment. It helps you understand the underlying power dynamics of your market, which is crucial for long-term strategic planning.

Here are the five forces:

- Competitive Rivalry: How intense is the competition between existing companies?

- Threat of New Entrants: How easy is it for a new startup to enter your market?

- Bargaining Power of Buyers: How much power do your customers have to drive down prices?

- Bargaining Power of Suppliers: How much can your vendors (like cloud hosting) raise their prices?

- Threat of Substitutes: Are there different ways customers could solve their problem without you?

- What's our core use case? Be specific. What is the one job a customer hires your product to do?

- Who is our ideal customer profile (ICP)? Pinpoint the industry, company size, and roles you serve.

- What's our geographic focus? Are you local, national, or global?

- Product and Pricing: Document every feature, all pricing tiers, and free trial limitations.

- Customer Voice: Dive into reviews on G2, Capterra, and Reddit. What do customers love? More importantly, what do they hate?

- Marketing and SEO: Use a tool like Ahrefs or Semrush to check their website traffic, the keywords they rank for, and who links to them. This tells you how they get customers.

- The Opportunity: Could you build AI into your platform to automate a tedious task your competitors still make users do manually? This could be a game-changing differentiator.

- The Threat: Could a new AI tool solve your customer's main problem in a much simpler way, making your solution feel clunky?

- Data Collection Without Insight: Creating a massive spreadsheet of features is easy, but it's useless without understanding the "why." The goal isn't a checklist; it's to uncover strategic gaps.

- Analysis Paralysis: Don't get stuck waiting for perfect data. The point is to gather enough good information to make smarter, faster decisions.

- Ignoring the Customer's Voice: Skipping customer reviews on sites like G2 and Capterra is a huge mistake. This is where you find raw, unfiltered feedback on your competitors' real-world strengths and weaknesses.

For a SaaS founder, the threat of new entrants is huge. If barriers to entry are low—for example, if a competitor could clone your product with open-source tools—you know that your focus has to be on building a powerful brand and a loyal community. That becomes your competitive advantage.

Ultimately, these frameworks help you move from simply collecting data to building a winning strategy.

A Step-By-Step Guide to Your First Analysis

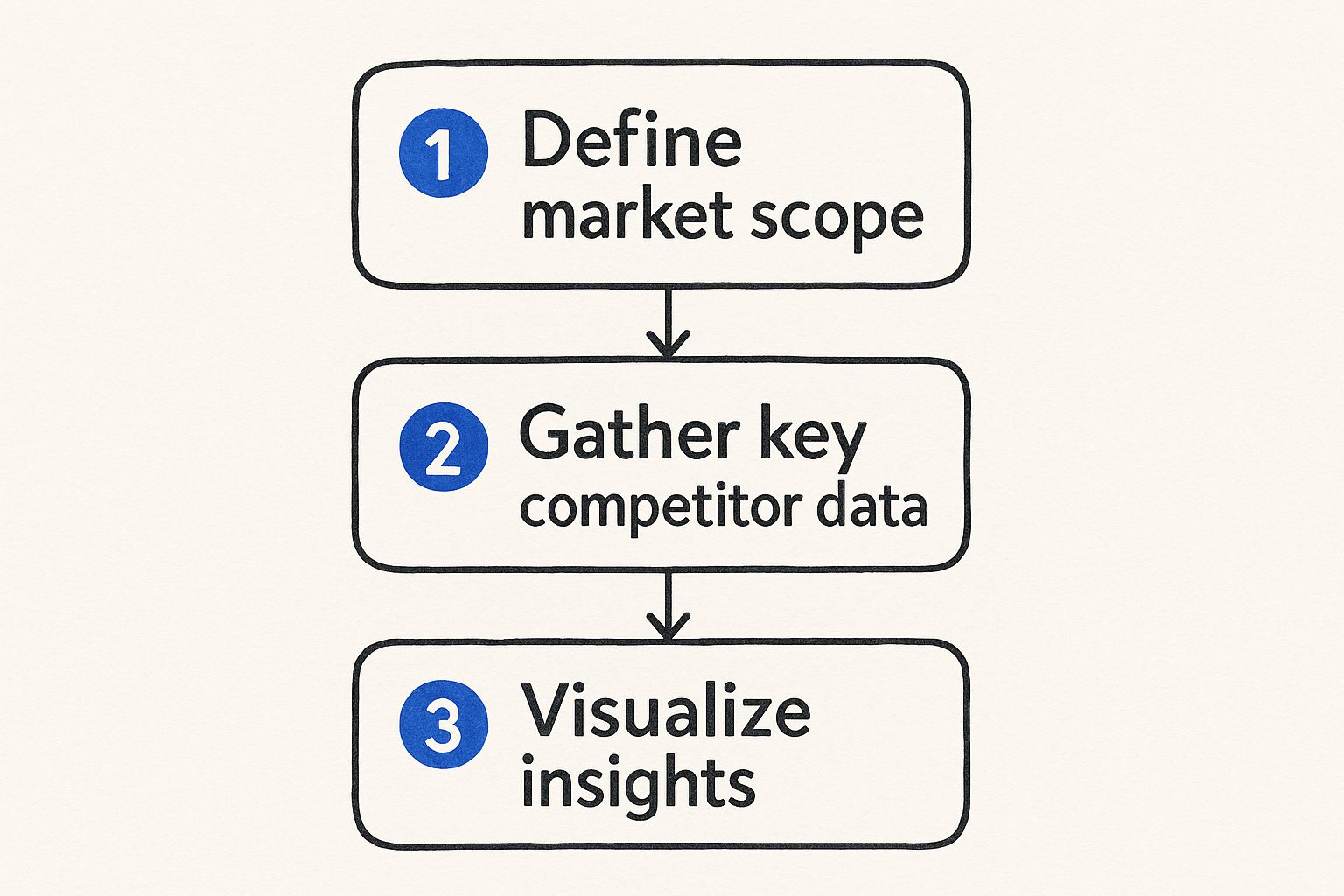

Alright, you understand the frameworks. Now it's time to take action. Running your first competitive landscape analysis can feel like a huge task, but breaking it down into a repeatable process makes it manageable. This roadmap will walk you through everything, from identifying competitors to presenting your findings.

Think of this as a core business skill you're building. Each time you go through this cycle, you'll get smarter and more in tune with market shifts.

This visual gives you a high-level view of the core stages.

The key takeaway is how one step flows into the next. You can't gather the right data if you don't know what you're looking for, and you can't find insights without quality data.

1. Define Your Market Scope

Before you hunt for competitors, define your sandbox. What specific problem are you solving, and for whom? Getting this right saves you from drowning in irrelevant information.

Ask yourself:

Nailing this ensures your analysis is sharp and actionable.

2. Identify and Categorize Your Competitors

Now, build your list of rivals using the direct, indirect, and emerging categories. A simple Google search with keywords your customers use is a great start.

But don't stop there. Spend time on software review sites like G2 and Capterra. See who consistently appears next to the competitors you already know. You'll often uncover threats you wouldn't have thought of otherwise.

3. Gather Crucial Competitor Data

This is where the real work happens. It’s time to collect the raw materials for your insights. You'll need a mix of hard numbers and qualitative feedback. I highly recommend setting up a spreadsheet to keep it all organized.

> This step is more than just checking off features. You're trying to understand the story behind the data. Why did they choose that pricing model? What does their marketing copy tell you about who they’re targeting?

Make sure your data collection covers:

4. Analyze and Find the Gaps

With your spreadsheet full of data, the search for patterns begins. Look for trends and empty spaces. Are all your competitors focused on enterprise clients, leaving small businesses underserved? Do you see a dozen reviews all complaining about the same missing feature?

This is where you connect the dots to find a strategic opening—a corner of the market you can own. This is where a platform like Proven SaaS can be a massive shortcut, using AI to analyze ad spend and revenue signals to show you which SaaS ideas are already validated.

5. Visualize and Share Your Findings

Finally, turn that dense spreadsheet into a simple, compelling story. No one wants to read a 50-page report. Use visuals like a SWOT analysis grid or a feature comparison table to make your insights clear.

Your analysis should lead to a handful of actionable recommendations for your product, marketing, and overall business strategy.

Looking Beyond Your Competitors: Market and Tech Trends

A solid competitive landscape analysis goes beyond just sizing up your rivals. It’s about looking at the horizon to see the big currents that will shape your market tomorrow. Your real competition isn't just another business—it's the future itself.

Larger forces, like emerging technologies, new regulations, or economic shifts, can create incredible opportunities or pose genuine threats. Ignoring them is like sailing while only watching other boats, completely missing the storm on the horizon.

How Technology Changes the Game

New tech is constantly redrawing the map. Take the explosion of generative AI. It's not just a trend; it’s a seismic shift creating new product categories while making others obsolete.

Here's how this applies to you:

Keeping your head up means tracking these shifts, experimenting with new tools, and constantly asking how they could reshape your product.

> A forward-looking analysis accepts that your biggest threat might not come from a known competitor, but from an innovation that completely changes customer expectations. Adapting isn’t just a good idea; it’s how you stay in the game.

The Impact of Rules and Global Events

Beyond tech, the rules of the game are always changing. New laws and geopolitical events can shake up the competitive environment.

Data privacy laws are a perfect example. Complying with regulations like GDPR isn't just about avoiding fines; it’s a chance to build trust. If you design your product around strong data protection from day one, you’ll earn customer confidence that slower competitors can't match. Our own guide on SaaS privacy policies dives deeper into this.

Likewise, global dynamics increasingly influence tech. Countries are pouring money into local chip manufacturing and sovereign cloud infrastructure to gain an edge. This ushers in a new era of competition where national interests heavily influence key sectors like AI. You can read more about how geopolitical forces are shaping tech trends on mcksinsey.com.

This forward-looking perspective helps you build a resilient company. By analyzing these bigger trends, you stop reacting and start positioning your business to ride the wave of change.

Frequently Asked Questions

Jumping into a competitive landscape analysis can feel overwhelming, and it's natural for questions to pop up. For founders trying to make smart, data-driven decisions, getting clear answers is key. We've gathered some of the most common questions to help you get started.

How Often Should I Do a Competitive Analysis?

Your competitive analysis should be a living document, not a "set it and forget it" project. The market moves fast. For most SaaS companies, a major deep-dive once a year is a good rule of thumb.

This big annual review helps you set your high-level strategy. But you can't stop there. Supplement that with lighter quarterly check-ins. These are perfect for spotting tactical changes like new pricing, big marketing campaigns, or a shift in customer feedback.

> Think of it like this: your annual analysis is the full-scale map of the country, while your quarterly check-ins are like checking Google Maps for traffic before a meeting. Both are essential for getting where you're going.

This rhythm keeps you from ever being blindsided and ensures your strategy is both solid and adaptable.

What Are the Most Common Mistakes to Avoid?

Founders often fall into a few common traps that make their analysis less effective. Knowing them is half the battle.

The biggest mistake? Focusing only on direct competitors. The real threat can often come from an indirect rival solving the same problem in a different way. A simple spreadsheet is an indirect competitor to a complex project management tool; ignoring that means you misunderstand a huge part of your market.

Here are a few other pitfalls:

What Free Tools Can I Use to Get Started?

You don't need a huge budget to get started. You can gather powerful insights using free tools and a bit of effort.

A great first step is setting up Google Alerts for your competitors' brand names. This gives you a steady stream of intel. At the same time, subscribe to their newsletters and follow them on social media. Pay close attention to their messaging—how do they talk about the problems they solve?

For a deeper dive, customer review sites like G2 and Capterra are goldmines. They give you direct, honest feedback from actual users. If you run into any trouble pulling this data together, our team is here to help—just visit our Proven SaaS customer support page for assistance.

---

Ready to stop guessing and start building with confidence? Proven SaaS is the intelligence platform that shows you which SaaS ideas are already profitable. We analyze real-world ad spend to surface validated niches, helping you build a product the market is already paying for. Discover your next profitable SaaS idea today.

Article created using Outrank

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders