A Clear Guide to Series A Investments: Fueling Your Startup's Growth

You've survived the seed stage. You’ve proven your idea isn't just a dream and found that magical connection called product-market fit. So, what's next? Welcome to the Series A round—this is where your startup stops being an experiment and starts becoming a real, scalable business.

This isn't about tinkering with an idea anymore. Series A funding is the first major institutional money you'll likely raise, and it’s all about growth. Think of it as the high-octane fuel you need to take a proven model and hit the accelerator.

From Foundation to Skyscraper: The Role of Series A Investments

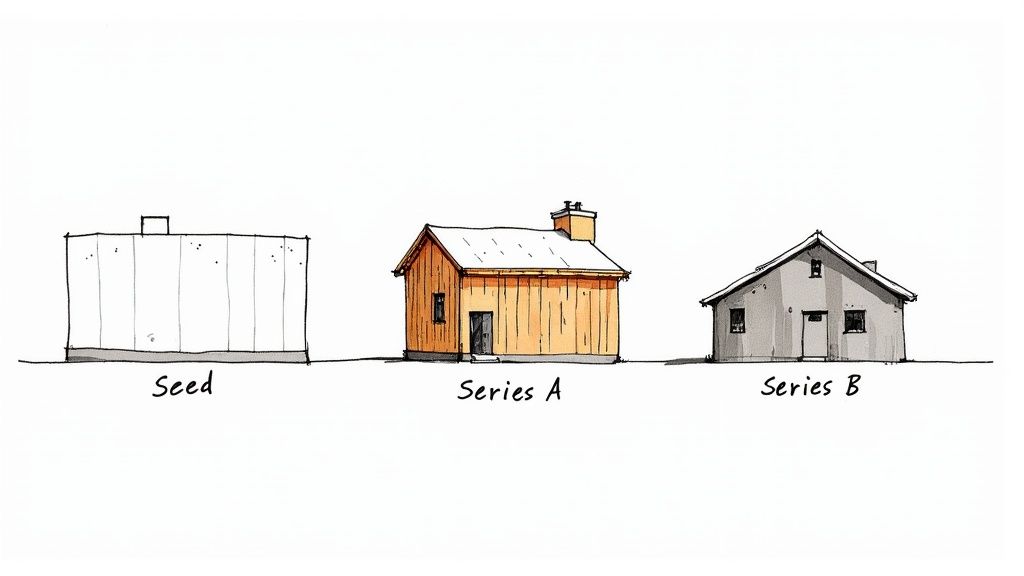

Think of your startup's journey like building a house. Seed funding laid the foundation—validating your concept and building a minimum viable product (MVP). Series A investments are where you start putting up the frame, the walls, and the roof.

This is the round that provides the heavy-duty resources to turn a promising product into a high-growth company ready to capture a serious chunk of the market. The focus shifts entirely from finding a business model to aggressively executing one that already works.

What Is Series A Funding For?

At its core, a Series A round is about two things: optimizing and scaling. Founders use this capital to build a proper team, sharpen their market strategy, and rapidly grow their customer base.

The main goals usually boil down to:

- Hiring key talent: Finally building out dedicated engineering, sales, and marketing teams.

- Product development: Moving beyond the MVP to add features that customers demand and enhance the user experience.

- Market expansion: Pushing into new territories or targeting different customer segments.

- Customer acquisition: Pouring money into marketing and sales channels that you’ve already proven to be effective.

The Scale of Series A Funding

This funding stage is a massive engine for the global startup ecosystem. Series A investments fuel innovation everywhere, especially in hot sectors like AI and biotech.

> To give you an idea of the scale, recent data shows that over 11,130 Series A startups worldwide raised a combined $6.3 billion in a single year. That’s a staggering amount of capital dedicated to helping young companies grow. You can dive deeper into these startup funding trends and see the full dataset from Growth List.

Ultimately, a successful Series A round gives you more than just cash. It brings experienced venture capitalists to your board—strategic partners who offer guidance, open doors, and help you navigate the tricky path to a Series B and beyond. At that point, the goal isn't just scaling; it's about total market domination.

Are You Ready? Hitting the Key Milestones for Series A

When you knock on a VC's door for a Series A investment, you’re no longer selling a dream. You're selling a well-oiled machine that's ready for more fuel. Venture capitalists look for predictable growth, which means your story has to shift from "look what we could do" to "look what we are doing."

This all starts with a concept called Product-Market Fit (PMF). It’s a term that gets thrown around, but for Series A investors, it’s not an abstract feeling—it’s something they expect to see clearly in your data. It’s the proof that you’ve moved beyond a few friendly early adopters to a growing base of customers who genuinely rely on your solution.

Having a cool product isn’t enough. You need to show that a real, sizable market is actively choosing it. If you're still figuring this part out, our guide on how to find product-market fit is a great place to start.

Turning Traction into Investor Confidence

So, how do you actually prove you’ve hit this critical stage? You do it with numbers. Investors need to see hard metrics that tell a clear story of growth. Vague claims and vanity metrics won't fly.

Your key performance indicators (KPIs) must paint a picture of an upward trend, validating that your business model works. This data becomes the bedrock of your pitch, showing that your early success isn't just a fluke but a repeatable process.

> The bottom line is simple: every dollar an investor gives you needs a clear path to generating several more in return. Your job is to prove you've already built the machine that can do that.

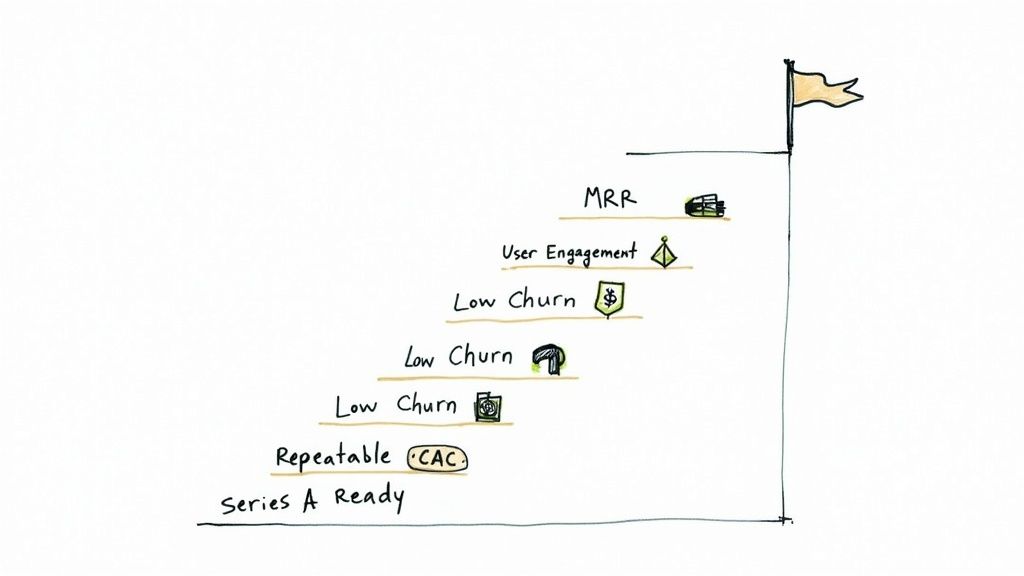

Here are a few of the core metrics investors will zoom in on:

- Monthly Recurring Revenue (MRR): For any SaaS company, this is your heartbeat. Consistently growing MRR shows you have a stable customer base and a predictable income stream.

- Customer Churn Rate: How many customers are leaving each month? A low churn rate is powerful proof that your product is sticky and provides real, lasting value.

- Customer Acquisition Cost (CAC): How much do you spend to get a new customer? VCs need to see that this number is reasonable and that you can acquire users efficiently.

User Engagement: Are people actually using* your product? Metrics like daily active users (DAUs) or the time they spend in your app show that your solution is more than just a nice-to-have.

The Series A Readiness Checklist

Before you build an investor list, take an honest look in the mirror. Are you really ready for Series A? Investors want to see that the fundamental building blocks of a scalable company are already in place.

The table below is a quick checklist to see how your startup measures up. Think of each item as a critical proof point VCs will use to vet your potential for explosive growth.

Startup Readiness Checklist for Series A Funding

| Metric/Milestone | What It Means | Typical Target Range |

|---|---|---|

| Product-Market Fit | You've built something the market genuinely needs and is willing to pay for. | Strong user engagement, positive feedback, and low customer churn. |

| Consistent MRR | You have predictable revenue and a business model that clearly works. | $15k to $100k+ per month, with a consistent growth rate. |

| Repeatable GTM Plan | You have a scalable, proven process for acquiring new customers. | At least one or two efficient customer acquisition channels are working well. |

| Defined Leadership Team | You have the right people in place to execute the vision and manage growth. | Key roles (CEO, CTO, etc.) are filled by capable, experienced leaders. |

Hitting these milestones is about much more than checking boxes. It’s about building a strong, defensible business that can take a significant injection of cash and turn it into market leadership.

When you can walk into a pitch meeting with solid data to back up every single claim, you’re not asking for a leap of faith anymore. You’re presenting a calculated, high-growth opportunity.

How Series A Valuations Actually Work

Figuring out a Series A valuation can feel like a mystery. It’s a common myth that your company's worth is just a simple math problem, like a multiple of your revenue. The truth is, your valuation is a story—a story told with both hard numbers and a compelling vision for the future.

While your metrics, like Monthly Recurring Revenue (MRR) and growth rate, lay the groundwork, they don't paint the full picture. It's often the less tangible factors that can turn a good valuation into a great one.

The Tangible Metrics Investors Scrutinize

Before an investor gets to your big-picture vision, they need to see that the engine is running smoothly. Think of your core metrics as the first hurdle; if the numbers aren't there, it's almost impossible to even start the conversation.

Here's what they'll be digging into:

- MRR and Growth Rate: Strong, consistent growth is the clearest signal you have something special. A startup growing at 20% month-over-month is in a different league than one growing at 5%, even if their current revenue is exactly the same.

- Gross Margins: For a SaaS business, you want to see gross margins above 80%. This shows your business model is fundamentally efficient and that each new dollar of revenue is highly profitable.

- Customer Retention and Churn: Low churn is proof that your product isn't just a "nice-to-have"—it's a "must-have." Happy customers who stick around are the best evidence of true product-market fit.

- Unit Economics: Investors need to see a clear path to profitability. That means your Customer Lifetime Value (LTV) has to be way higher than your Customer Acquisition Cost (CAC). A healthy LTV/CAC ratio, often 3:1 or better, proves you've built a growth machine that's both sustainable and scalable.

These metrics are your table stakes. They build the quantitative case for your series a investment. If you want to get deeper into the calculations, our guide on how to value SaaS companies breaks down the models in more detail.

The Intangibles That Drive Valuations Higher

This is where the "art" of valuation comes into play. It’s why two companies with identical revenue can end up with wildly different price tags.

> A strong narrative can be just as impactful as strong metrics. Investors are buying into your future potential, and your ability to articulate a massive vision is what commands a premium valuation.

Think of it this way: your metrics prove you’ve built a solid car, but the intangibles are what convince investors it's actually a rocket ship.

Example: The Valuation Story

Let's look at two SaaS startups, "Company A" and "Company B." Both are at $1 million in Annual Recurring Revenue (ARR).

- Company A is in a crowded market. The founding team is capable but has no previous exits. Their product works well, but a competitor could easily copy it. They land a $10 million valuation.

- Company B is tackling a brand-new market with a unique technological advantage. The founders have already built and sold a successful company. Their vision is to own a massive, untapped category. They get a $25 million valuation.

What explains that huge gap? Company B told a much better story. The experienced team, the defensible tech, and the enormous market opportunity made investors confident in paying a much higher price. This is why you see a wide range in deal sizes. For instance, the median deal size for Series A rounds in the U.S. has hovered around $18 million in recent years, a number driven by both solid metrics and these powerful intangibles. You can discover more insights on recent venture trends on Crunchbase News.

Key factors that drive valuations skyward include:

- The Team: Do the founders have a unique insight? Have they done this before? A world-class team is a huge de-risking factor.

- Market Size (TAM): Are you chasing a billion-dollar opportunity or a small niche? VCs need to see a clear path to a massive outcome to justify the risk.

- Defensibility: What's your "moat"? This could be proprietary technology, a powerful brand, or network effects. It’s what stops someone else from eating your lunch.

At the end of the day, your Series A valuation is a negotiation. By building a powerful case with both rock-solid metrics and a visionary story, you put yourself in the best position to command the valuation you deserve.

Your Step-by-Step Fundraising Playbook

Raising a Series A round is a marathon, not a sprint. Think of it as a full-time job on top of your actual full-time job. It’s a structured process that takes preparation, smart outreach, and tough negotiation. By following a clear game plan, you’ll not only stay sane but dramatically boost your chances of landing the right investors.

This is your roadmap, from the first draft of your pitch deck to the moment the money hits your bank account.

Phase 1: Crafting Your Narrative

Before you talk to an investor, you need to nail your story. This story lives in your pitch deck, which is the most important document you'll create during this entire process.

Many founders make the mistake of creating a dry, data-heavy presentation. Yes, your numbers matter—a lot. But a compelling story is what gets an investor to sit up and pay attention. It’s what makes them believe.

Your narrative needs to clearly and convincingly answer these questions:

- The Problem: What massive, painful problem are you solving?

- The Solution: How does your product solve it in a unique and better way?

The Market: How big is this opportunity, really*?

- The Traction: What have you already proven with real customers and data?

- The Team: Why are you the only people on the planet who can pull this off?

VCs see hundreds of decks. Yours has to be memorable. Keep it concise, and build a narrative that makes your success feel inevitable. Every slide should feed into the next, creating an undeniable case for why your company is a can't-miss Series A investment.

Phase 2: Building Your Investor Pipeline

Okay, you’ve got a killer deck. Now what? The worst thing you can do is blast it out to every VC you can find. Fundraising is a game of precision, not just numbers.

You need to build a highly targeted list of investors. Look for firms that have a track record in your industry, invest at your stage, and write checks in the size range you're looking for.

A great way to start is by researching the investors who backed companies you admire or who play in a similar field. Don't just look at the firm; dig into the specific partners. Your goal is to find people whose expertise and network can give you more than just cash.

> The absolute best way to connect with these investors is through a warm introduction. Cold emails rarely work. An intro from a trusted founder, lawyer, or angel investor in their network can land you a meeting with a partner right away.

Phase 3: Navigating Meetings and Due Diligence

Once meetings start, your main job is to build momentum. You'll likely talk to several people at a firm—associates, principals, and then partners. Get ready for tough questions. You need to know your market, your metrics, and your competition inside and out.

If a firm is getting serious, they’ll signal their intent to move forward. This usually leads to a final partner meeting where the make-or-break decision happens. A "yes" here means you're diving into the most grueling part of the process: due diligence.

Due diligence is a full-body scan of your business. The investors and their lawyers will comb through everything: your financials, legal documents, customer contracts, and tech stack. Having all of this organized and ready in a virtual data room is absolutely critical to keeping things moving smoothly.

This is where your story and your data come together under a microscope.

As you can see, a solid valuation isn't just about your revenue. It's a blend of hard numbers and the intangible strengths of your team and vision—all of which get put to the test during due diligence.

Phase 4: Negotiating the Term Sheet and Closing

Once you clear due diligence, the investors will send over a term sheet. This document lays out the basic terms of their investment. The valuation is the big headline number, but it’s far from the only thing that matters.

Pay close attention to these key terms:

- Board Seats: How much control are you giving up over major company decisions?

- Liquidation Preference: In an exit, who gets paid first and how much do they get?

- Pro-rata Rights: Can your new investors maintain their ownership percentage in future funding rounds?

- Vesting Schedules: Are there new vesting requirements for you and the other founders?

Getting these terms right is hugely important. They'll define your relationship with your investors for years to come. It’s wise to get familiar with the language and structure of these agreements early on. Reviewing a few letter of intent templates for business can give you a solid foundation before you’re in the hot seat.

After you sign the term sheet, lawyers draft the final paperwork, and the money gets wired to your company’s bank account. This last leg can still take a few weeks. But once it's done, you've officially closed your Series A.

Congratulations. Now the real work begins.

Understanding Your New Partners

Landing a Series A investment feels like a huge win, but it’s not just about the money. You’re starting a long-term, high-stakes relationship that will fundamentally change how your company operates. The venture capitalists (VCs) leading your round are now your business partners, and it's crucial to remember that not all capital—or partners—is the same.

This isn’t a hands-off investment. When a VC firm leads your Series A, they're making a serious bet on your vision and will want to be actively involved. That almost always means taking a seat on your board of directors, giving them a significant say in major decisions for the next five to ten years.

What Investors Expect from You

Your pitch deck and traction are important, but Series A investors are really betting on the people behind the numbers. They’re looking for a few key traits that signal you have what it takes to build a billion-dollar company.

Here’s what they want to see:

- A Massive Vision: Are you making a minor tweak to an existing product, or are you trying to completely reshape an industry? VCs are hunting for founders with a vision big enough to deliver a 10x return on their investment, at a minimum.

- An Unstoppable Team: Do you have the right people on board to actually pull it off? They need to be convinced your team has the skill, grit, and expertise to navigate the inevitable roadblocks and outwork the competition.

- Coachability and Transparency: Investors need to know you're open to advice, can handle tough conversations, and will be honest about what's working and what isn't. The best founder-investor relationships are built on a foundation of trust.

It's also worth noting how the VC world is changing. Recently, a full one-third of all U.S. venture capital came from deals involving just the six largest funds. This trend is being driven by huge AI funding rounds, highlighting a massive appetite for promising AI startups. You can dig deeper into these market dynamics in SVB's report.

Flipping the Script: What You Should Ask Investors

Remember, this is a two-way street. Investors are grilling you, but you need to be doing the same to them. Finding the right partner is arguably more important than squeezing out the highest possible valuation. The wrong investor can create years of friction and headaches.

> You are choosing a business partner for a multi-year journey through good times and bad. Make sure their values, communication style, and vision for the company align with your own.

Before you even think about signing a term sheet, get straight answers to these questions:

- What is your decision-making process? You need to understand how they work. Ask how they’ve handled board-level disagreements or supported founders through a painful pivot.

- How do you help your portfolio companies beyond capital? Don't settle for vague answers. Ask for specific examples of them helping with executive hires, landing a game-changing customer, or navigating a future funding round.

- Can I speak with founders you've backed? This is non-negotiable. Talk to founders from their successful and their struggling companies. It's the only way to get the real, unfiltered story of what it's like to have them on your team.

- Not Being Ready for Due Diligence: This part of the process is no joke. If your data room is a mess or you're scrambling to answer basic questions about your finances, it sends a clear signal: you're not ready for institutional money.

- Giving Up Too Much Control: The valuation number isn't the only thing that matters. Pay very close attention to board seats, liquidation preferences, and other protective provisions in the term sheet. Giving up too much control this early can cripple your ability to lead your own company down the road.

- Treating it Like a Transaction: Fundraising is about building relationships, plain and simple. Investors are betting on you just as much as they're betting on your business. Be honest, be yourself, and work on building a genuine connection through the entire process.

- The Amount Raised: The more money you take, the more equity you'll likely have to give up.

- Your Valuation: A higher pre-money valuation means you can raise the same amount of cash for a smaller slice of the company.

- Market Conditions: When the market is hot, founders often have more leverage and can negotiate less dilution.

- Raise a Bridge Round: This means going back to your existing seed investors for a smaller injection of cash. The goal is to buy yourself another 6-12 months of runway to hit the milestones VCs wanted to see.

- Focus on Profitability: It's time to get lean. Cut non-essential costs, focus all your energy on what's already making money, and push to become self-sufficient without needing outside investment.

- Pivot the Business: The feedback you got from VCs is pure gold. Use it. You might need to adjust your product or shift your target market to find that sweet spot investors are looking for.

Choosing your Series A investor is one of the biggest decisions you'll ever make as a founder. Take your time. Find a true partner who brings more than just money to the table—someone who adds real strategic value and is aligned with you for the long haul.

Common Mistakes to Avoid in Your Series A

Getting your Series A over the line is a huge milestone, but the road is littered with pitfalls that can trip up even the most promising startups. The best way to navigate it smoothly is to learn from the mistakes others have made. Dodging these common blunders won't just improve your odds of closing a deal—it’ll help you build a much stronger company.

One of the first places founders go wrong is by casting their net too wide. In a panic to create competition, they shotgun their deck out to dozens of VCs at once. This "spray and pray" tactic usually backfires. VCs talk, and if they all hear a slightly different version of your story or sense a lack of focus, your reputation can take a hit.

A focused, tiered strategy works much better. Start with a small, hand-picked list of investors who are a perfect fit for your vision and industry. Go after them first. Only broaden your search if those initial talks don't lead anywhere.

Overlooking Investor Alignment

This is a big one. Taking money from the wrong people is one of the most dangerous mistakes you can make. A high valuation might feel like a win, but if it comes from a misaligned investor, you're signing up for years of headaches. These people become your partners for the next 5-10 years, and a fundamental mismatch in vision or values can be toxic.

Always focus on finding partners who truly get your market and are bought into your long-term goals. An investor who only cares about growth at all costs might push you off a cliff when what you really need is to pivot or weather a market downturn.

> Remember, you're not just accepting capital; you're accepting a worldview. A misaligned board member can create immense friction, slowing down critical decisions and creating a toxic environment for the entire team.

Having Unrealistic Expectations

Walking into a pitch meeting with a sky-high valuation that has no basis in reality is the fastest way to kill your credibility. Ambition is great, but VCs can spot a founder who hasn't done their homework from a mile away. Your valuation has to be something you can defend with your metrics and a solid grasp of what's happening in the market right now.

Do your research. Look at comparable series a investments in your space. Talk to other founders and your advisors to get a real feel for what a company with your traction is worth today. This shows investors you’re a serious operator who knows their stuff.

Here are a few other critical mistakes to watch for:

By steering clear of these common missteps, you’re not just setting yourself up to close a round. You’re building a solid foundation for the future with the right people in your corner.

Your Top Questions Answered

Let's be honest, navigating the world of Series A funding can feel like a maze. You're not alone if you have a lot of questions. Here are some quick, straightforward answers to the things founders ask most often.

How Long Does a Series A Round Take?

Brace yourself: a typical Series A round takes anywhere from three to six months from start to finish. That’s from the very first investor email you send to the moment the cash actually hits your bank account.

Think of it in stages. You'll spend about one to two months just getting your materials ready and starting outreach. Then, another month or two will be packed with initial meetings and follow-up calls. The final stretch, which includes due diligence and all the legal paperwork, easily takes another one to two months. The more you prepare upfront, the faster this whole process will go.

How Much Equity Do Founders Give Up?

For a standard Series A round, expect to sell between 20% and 30% of your company. This is what's known as dilution, and it's a completely normal part of bringing on venture capital partners.

The final percentage isn't set in stone, though. It usually comes down to a few key things:

What Happens if I Fail to Raise a Series A?

Failing to close a Series A round is a tough pill to swallow, but it’s definitely not the end of the road. Think of it as a critical moment to pause, listen to the feedback, and decide on a new game plan.

> Not closing a round is a signal from the market. Your job is to listen to that signal and decide whether to pivot, bootstrap to profitability, or seek a different type of funding to extend your runway.

You still have several solid moves you can make:

---

Ready to stop guessing and start building a business with proven demand? At Proven SaaS, we analyze millions of ads to uncover profitable SaaS ideas that are already working. Find your next validated business idea today at https://proven-saas.com.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders