Fighting churn isn't about randomly trying tactics to see what sticks. It’s a detective-like process to figure out why users leave and then give them compelling reasons to stay. This is a direct, no-fluff playbook for founders who want to turn a leaky bucket into a solid foundation for growth. We'll focus on diagnosing the real issues and using retention strategies that actually work.

Why Fixing Churn Is Your Biggest Growth Lever

Let's be clear—customer churn is a silent killer for a SaaS business. It’s easy to get caught up in finding new customers, but that often means neglecting the quieter, more profitable work of keeping the ones you already have. This is a huge mistake. Even a small improvement in retention can have a massive impact on your bottom line.

The numbers don't lie. For SaaS companies, the average annual churn rate is around 10–14%, but a "good" rate is under 5%. That gap is a huge opportunity. Top-performing B2B SaaS companies often see annual churn around 3.5–5%, and the best enterprise products can even dip below 3%.

To see what this means, imagine you have 1,000 customers paying $99/month. The difference between a 3% and 7% monthly churn rate isn't small change—it’s about $480,000 in annual recurring revenue either saved or lost. You can dig into more SaaS churn rate benchmarks to see how you stack up.

The Churn Reduction Framework

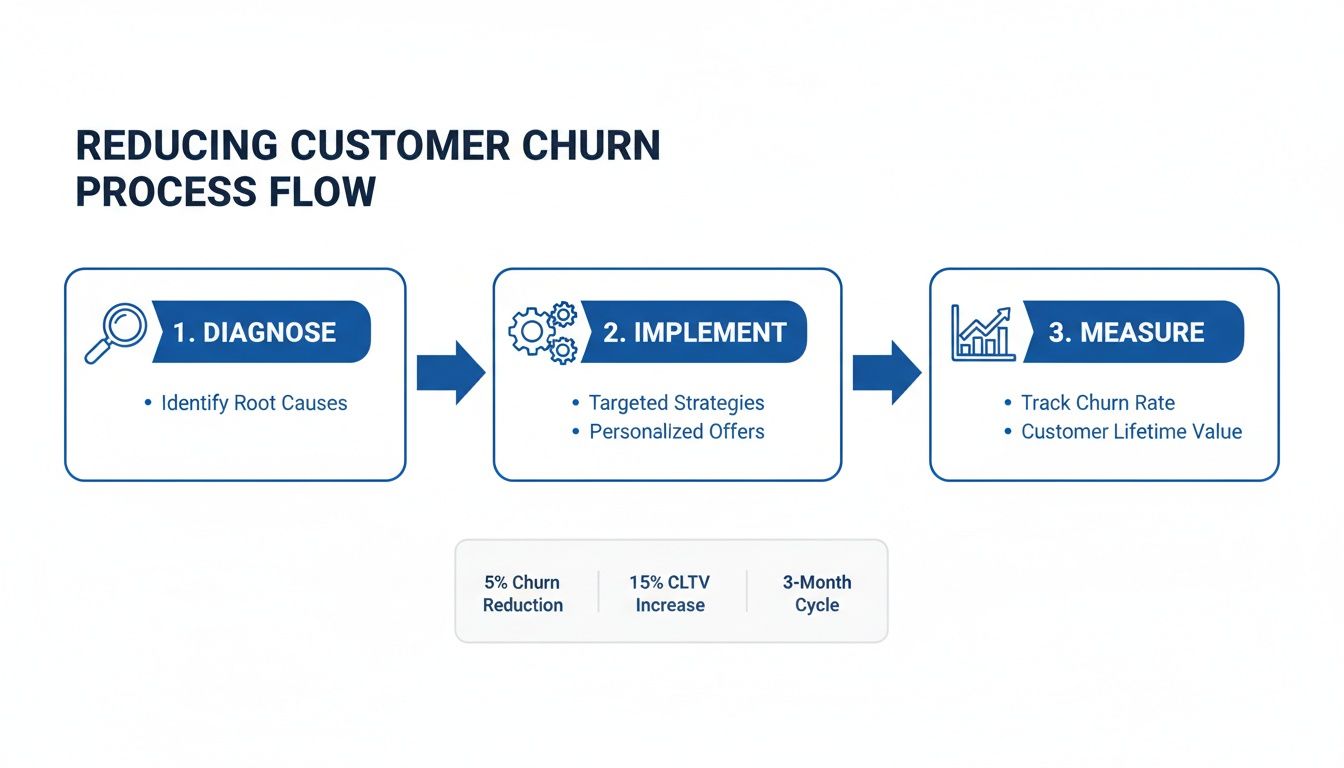

You can't just try random things and hope for the best. To tackle churn effectively, you need a structured approach. I break it down into three simple phases: Diagnose the root causes, Implement targeted solutions, and Measure the impact.

"Churn is a symptom, not the disease. You can't just treat the symptom by offering discounts at the point of cancellation. You have to go upstream and solve the core problems that made a customer want to leave in the first place."

This simple flow chart is how I visualize the framework for fighting churn.

Think of this as a continuous cycle, not a one-time project. By consistently diagnosing issues, implementing fixes, and tracking the results, you create a powerful feedback loop that steadily strengthens customer loyalty.

Before we dive deep, here's a quick look at the main areas we'll focus on to get churn under control.

Key Levers for Reducing SaaS Customer Churn

A simple summary of the core areas to focus on when tackling customer churn, from initial diagnosis to long-term retention.

| Focus Area | Objective | Key Actions |

|---|---|---|

| Diagnosis | Understand the real reasons customers leave. | Combine quantitative data (product usage) with qualitative feedback (surveys, interviews). |

| Onboarding | Guide new users to their "aha!" moment faster. | Improve user welcome flows, create in-app tutorials, and offer proactive help. |

| Product & Features | Align your product with customer needs. | Prioritize features based on user feedback, fix bugs, and improve the user experience. |

| Engagement | Keep users active and seeing value. | Send targeted email campaigns, celebrate user milestones, and share best practices. |

| Pricing | Ensure your pricing feels fair and delivers value. | Review pricing tiers, handle failed payments gracefully, and offer flexible plans. |

| Support | Solve problems quickly and create advocates. | Improve response times, build a helpful knowledge base, and offer multi-channel support. |

| Winbacks | Bring back customers who have already left. | Run targeted campaigns with special offers for churned users who were a good fit. |

This table is our battle plan. Each of these levers represents a real opportunity to make your product stickier and your business healthier.

What to Expect From This Guide

This isn't just a list of generic advice. It's a hands-on playbook to give you clarity and a clear path forward. We're going to cover how to become a churn detective, uncovering why users really leave—not just the reason they give in a cancellation survey. You'll get a full toolkit of practical retention tactics for every stage of the customer journey, from the critical first week to long-term engagement.

Here’s a quick look at what’s ahead:

- Diagnose the real causes of churn: We'll move beyond assumptions by blending hard data with genuine human feedback.

- Implement targeted retention tactics: You'll learn how to fix a broken onboarding flow, improve your product based on what users actually want, and engage them before they think about leaving.

- Measure your progress: I'll show you the key metrics to track and how to build a system for continuous improvement.

By the end of this guide, you’ll have a clear roadmap of the specific actions you can take to boost customer loyalty, lock in your revenue, and build a more resilient SaaS business. Let's get started.

So, Why Are Your Customers Really Leaving?

Before you can fix churn, you have to play detective. I’ve seen too many founders jump straight to solutions—slashing prices or frantically building new features—without understanding the root cause. That's not a strategy; it's a panicked guess. To make a real dent in your churn rate, you have to find out why customers are actually hitting that cancel button.

The trick is to combine two types of clues: the "what" and the "why." The "what" is the cold, hard data from inside your product. The "why" comes from listening to the people who decided your tool wasn't for them anymore. Put them together, and you start to see the exact moments where you failed to deliver.

Dig Into Your Product Usage Data

Your first stop should be your own analytics. This means more than just glancing at daily active users. You need to get your hands dirty and look for patterns that signal a customer is about to churn.

The best way to start is by separating your churned users from your active, happy ones. Then, compare their behavior side-by-side. You'll often discover that churned users were sending distress signals long before they cancelled.

Here are a few critical red flags to look for:

- Low Feature Adoption: Are churned users ignoring a key feature that your power users love? Maybe it's hard to find, or its value isn't obvious.

- Drop-off After an Event: Do you see a spike in cancellations after a price increase or a major product update? That’s a clear trigger.

- Incomplete Onboarding: Did they leave before finishing a critical setup step? A user who never connects their calendar to your scheduling app is never going to experience that "aha!" moment.

- Decreasing Engagement: Watch for a slow fade in how often they log in or use key features. This is often the first sign a customer is slipping away.

A huge mistake is thinking all active users are happy. Someone might log in every day out of habit, but if they aren't using the core features that deliver value, they're a massive churn risk.

For example, imagine you run a project management tool and discover that 80% of churned customers never created a second project. That’s a giant, flashing neon sign. It tells you the initial promise—managing multiple projects—isn't connecting with most new users. The problem isn't the tool's power; it's that people aren't getting to it.

Get Candid Feedback Straight from Customers

While data tells you what's happening, it rarely tells you why. For that, you have to talk to people. This is the part where many founders get uncomfortable, but it's the most valuable work you can do. You need to create simple ways for departing customers to share their uncensored thoughts. This is where understanding your users is crucial. You can learn more about this by exploring what an audience analysis is and why it matters for SaaS growth.

The goal is to make it incredibly easy for them to give you feedback. A well-designed exit survey, presented right at the moment of cancellation, is your most powerful tool.

A great exit survey is:

- Short: No more than 2-3 questions. They're already leaving; don't give them homework.

- Open-Ended: Use text boxes instead of multiple-choice. You want their raw, unfiltered thoughts, not answers that fit into your predefined buckets.

- Focused on the "Why": Get right to the heart of their decision.

Here’s a simple but incredibly effective template for your cancellation flow:

- "What's the primary reason you're canceling your account today?" (Open text field)

- "What could we have done differently to keep you as a customer?" (Open text field)

- "Which competitor, if any, are you moving to?" (Optional, but great for competitive intel)

These direct insights are invaluable. You might discover a competitor has a killer feature you've overlooked, that your pricing is confusing, or that a nagging bug is finally pushing people away.

This data-first approach isn't just theory; it delivers real results. Companies that systematically use product analytics report retention improvements of around 15% compared to those just relying on relationship management. AI-driven churn prediction is also becoming the norm, with 46% of SaaS companies now using some form of it.

3 Key Strategies to Stop Churn in its Tracks

Alright, you've done the detective work and know why customers are leaving. Now it’s time to roll up your sleeves and fix the leaks.

This isn't about trying random tactics. It’s about being strategic. We're going to focus on three critical moments in the customer journey where you can have a massive impact: the first impression, the core product experience, and the ongoing relationship.

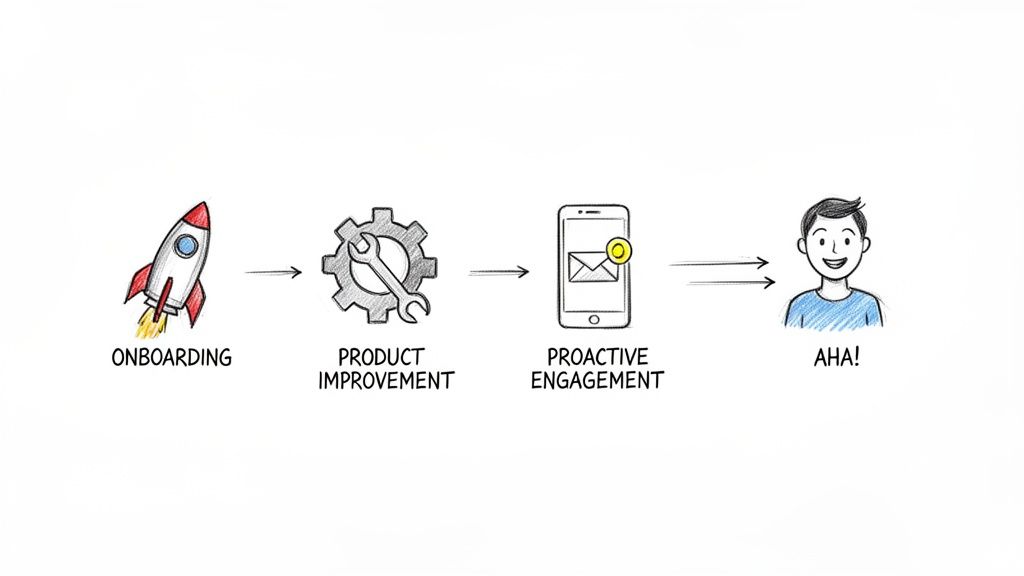

1. Perfect Your Onboarding to Create Instant Stickiness

A new user's first few days are everything. If they don't quickly find value—that "aha!" moment where your product just clicks—they probably won't stick around. A clunky, confusing onboarding process is a surefire way to kill momentum.

Think of onboarding as more than a product tour. It's a process that builds confidence and proves your product's worth from day one. In fact, 68% of users say they’re more loyal to businesses with great onboarding and education. You're turning curiosity into commitment.

Here's how to make your onboarding actually work:

- Build an interactive walkthrough. Don’t just show them around. Guide them through completing a critical first task. If you run a project management tool, walk them through creating their first project.

- Drip out welcome emails. Instead of one huge email, send a short series. Each email can introduce a single key feature or a powerful use case, keeping your product top-of-mind.

- Personalize the first steps. If your data shows users who complete a certain action (like an integration) are less likely to churn, make that action an unmissable step in their onboarding checklist.

Example: Let's say you run a social media scheduling tool. You notice that users who schedule their first five posts within 48 hours are 70% less likely to churn. That insight is gold. Your entire onboarding should focus on getting them to that milestone, using in-app tooltips, a progress bar, and maybe a celebratory email when they hit it.

2. Improve the Core Product Based on User Feedback

Sometimes the reason for churn is simple: your product has a frustrating bug, a clunky workflow, or it’s missing a key feature a competitor has. Your churn diagnosis should have highlighted these issues. Now, you have to show you're listening by fixing them.

This isn't about blindly building every feature request. It’s about prioritizing the improvements that will make the biggest difference to at-risk customers.

"A huge mistake is ignoring the small 'paper cut' bugs that your power users complain about. While a single small bug might not cause someone to churn, a dozen of them creates a death-by-a-thousand-cuts experience that signals you don't care about quality."

To get this right, you need a system.

- Tag all feedback by theme. Whether it's in your support tool or a feedback board, tag every comment with themes like "UI confusion," "billing issue," or "feature request: reporting." This helps you spot patterns instantly.

- Always close the loop. When you ship a fix someone asked for, email them personally. It’s a simple gesture that builds incredible goodwill.

- Focus on the "Job-to-be-Done." Before prioritizing a feature, ask if it helps customers do the core "job" they hired your product for. Anything that strengthens that core value is a higher priority.

Example: Imagine you run an invoicing tool and your exit surveys are full of complaints about how complicated it is to set up recurring invoices. That's a direct threat to your core promise. Making that workflow simple should immediately jump to the top of your product roadmap.

3. Build Proactive Engagement to Keep Users Successful

Even happy customers can drift away if they aren't regularly seeing value. Proactive engagement means reaching out before someone goes quiet. It’s about being a helpful guide, not just a reactive support line. The goal is to keep your product integrated into their workflow.

This doesn’t mean spamming them. It means sending the right message to the right person at the right time. Research from McKinsey shows that using data to spot at-risk users can cut churn by up to 15%.

Here are a few proactive plays that work:

- Set up behavior-triggered emails. Has a user not logged in for 14 days? Send a friendly, low-pressure email highlighting a new feature or a relevant case study.

- Use in-app nudges. Point out valuable features a user hasn't discovered yet with simple tooltips inside the app. It’s much more effective than hoping they’ll read a help doc.

- Celebrate their wins. Automatically send a "congrats!" message when a user hits a milestone, like "You just sent your 100th invoice!" This reinforces the value they're getting.

By bringing these retention tactics to life, you stop being a passive observer of churn and start actively building an experience that customers won't want to leave.

Choosing a Market with Low Churn Built In

So far, we’ve been talking about fixing churn from inside your business. But what if the real problem isn't your onboarding or product? What if the churn is coming from the market you chose to be in?

Sometimes, high churn isn't your fault. It's a structural feature of the industry you're serving. Picking the right market from the start can make retention dramatically easier, because some industries are just naturally "stickier" than others.

The secret ingredient here is switching costs.

When a customer weaves your tool so deeply into their daily operations that they can't imagine life without it, the pain of leaving becomes massive. It’s no longer about just canceling a subscription; it’s about migrating data, retraining a team, and blowing up established workflows. That friction is a powerful retention moat.

Spotting High-Stickiness Markets

The trick is to find markets where a product becomes an essential piece of a company's core infrastructure. Think of the "boring" back-office tools that are a nightmare to rip out once they're installed.

The data backs this up. Not all SaaS segments are equal when it comes to churn. For instance, SaaS tools for HR and back-office functions have a monthly churn around 4.8%. They've also seen massive growth, largely because the switching costs tied to payroll and benefits systems are so high. You can dive deeper into how churn rates vary by industry to see the benchmarks for yourself.

A "hot" new category might look tempting, but it can be structurally harder to keep customers compared to less glamorous, more embedded tools.

If you're a founder scouting for new ideas, here are a few signals of a low-churn market:

- Long-Running Ad Campaigns: See companies consistently buying ads for years? It's a great sign their churn is low enough to support those long-term acquisition costs.

- Integration-Heavy Products: Tools that require deep hooks into other critical systems (like CRMs or accounting software) create huge switching costs.

- Workflow-Critical Tools: Ask yourself: is this software essential for a core business function? If a company can't operate without it, they are far less likely to churn.

Choosing a market is the most important decision a founder makes. A great product in a terrible market will lose to a mediocre product in a great market every time. Your churn rate is often a direct reflection of the market you serve.

How This Shapes Your Strategy

This isn't just theory—it has real-world consequences for how you build and position your product.

If you knowingly enter a market with naturally high churn, you have to be ready for a dogfight. Your onboarding must be flawless, your support legendary, and your product constantly evolving.

But if you choose a market with high switching costs, your strategy shifts. Your primary goal becomes getting deeply embedded into your customers' workflows as quickly as possible. This approach ties your product's success to your customers' operational success, which naturally keeps churn low.

Thinking this way is a fundamental part of finding product-market fit. By understanding the structural dynamics of your market, you avoid building a business on a shaky foundation. To dig deeper, check out our guide on how to find product-market fit for your startup.

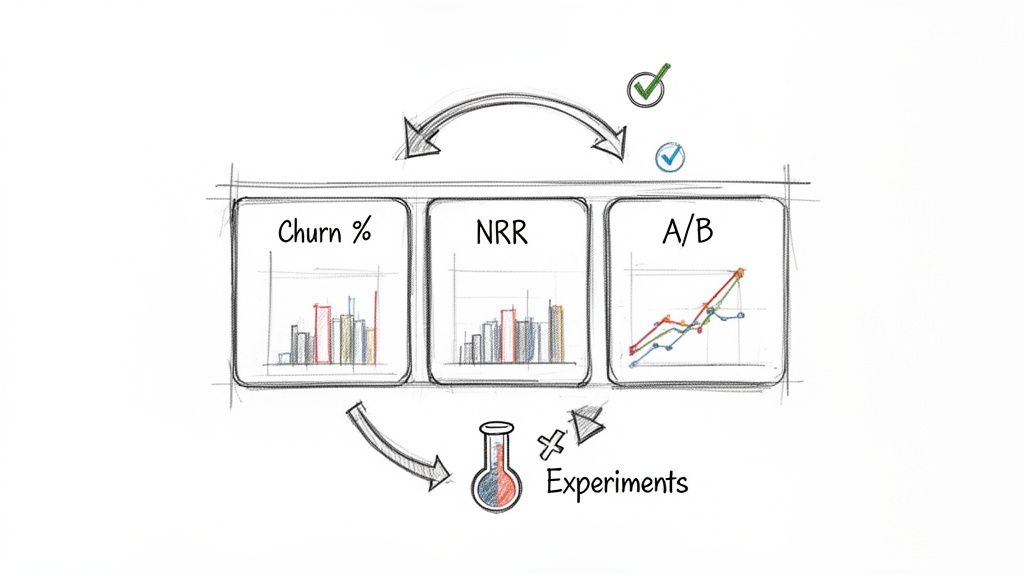

How to Measure Your Churn Reduction Efforts

Trying to reduce churn without measuring your efforts is like flying blind. You might be busy, but you have no idea if you're actually moving in the right direction. This isn't a one-off project; it’s a constant loop of testing, learning, and refining.

The goal is to move from guessing what works to knowing what works. This turns the reactive panic of fighting churn into a proactive, data-driven engine for growth. By running small, controlled experiments, you can finally see which ideas actually make customers stick around.

The Metrics You Actually Need to Watch

Before you can improve anything, you have to measure it. It’s easy to get lost in a sea of data, but a few key metrics tell you almost everything you need to know about the health of your business.

Here’s a quick rundown of the essential churn and retention metrics every SaaS founder should have on their dashboard.

Essential Churn & Retention Metrics

| Metric | What It Measures | Why It's Important |

|---|---|---|

| Customer Churn Rate | The percentage of customers who cancel their subscription in a specific period (e.g., a month). | This is your baseline. It tells you how many logos you're losing but not the full financial picture. |

| Revenue Churn Rate | The percentage of monthly recurring revenue (MRR) lost from cancellations and downgrades. | Often more critical than customer churn. Losing one big client can hurt more than ten small ones. |

| Net Revenue Retention (NRR) | Total revenue from an existing customer cohort, including upgrades (expansion) and downgrades (contraction), minus churn. | The gold standard. An NRR over 100% means your existing customers are outspending the revenue you lose from churn. |

These metrics give you a clear, multi-dimensional view of customer loyalty and its impact on your bottom line.

Net Revenue Retention is your clearest signal of a healthy, sticky product. It proves the value your customers get is actually growing over time—the ultimate defense against churn.

When you focus on NRR, you naturally start thinking beyond just preventing cancellations. It pushes you to find ways to deliver more value, leading to expansion revenue that can completely offset churn. For a deeper dive, you can check out industry benchmarks on SaaS MRR growth rates and what they mean for your business.

Running Small, Controlled Experiments

With your baseline metrics in hand, it's time to experiment. The goal is to isolate a single change and see if it actually impacts churn. This is where A/B testing becomes your best friend.

Instead of rolling out a huge feature to everyone and hoping it works, you test your idea on a small segment first. It’s a science experiment for your business: form a hypothesis, run the test, and analyze the results.

Let’s walk through a real-world example.

Your Hypothesis: "We believe our new interactive onboarding checklist will get users to their 'Aha!' moment faster, leading to a 10% drop in first-month churn."

Here’s how you’d test it:

- Create Two Groups: Randomly split new signups. Group A (the control) gets the old onboarding. Group B (the variant) gets the new interactive checklist.

- Run the Test: Let the experiment run for a set period, like 30 or 60 days, to gather enough data.

- Analyze the Results: After the test, compare the first-month churn rates for both groups. If Group B’s churn is significantly lower, you’ve got a winner.

You can apply this exact framework to almost any retention idea, from tweaking your pricing page to testing a new win-back email.

How to Prioritize Your Experiments

You’ll probably have dozens of ideas for fighting churn. The trick is to focus on the ones with the biggest potential impact for the least amount of effort. A simple framework like ICE (Impact, Confidence, Ease) can be a huge help.

For each idea, ask yourself:

- Impact: How much do we think this will really move the needle on our key metrics?

- Confidence: Based on data or user feedback, how sure are we that this will work?

- Ease: How hard will this be to build and implement? Are we talking hours or weeks?

Score each factor from 1 to 10, and you’ll quickly see which ideas are the true low-hanging fruit. This is how you build a data-driven culture of continuous improvement—the kind that separates companies that struggle with churn from those that master retention.

A Few Common Questions About Taming Churn

As you put these ideas into action, some questions will pop up. Fighting churn can feel complicated, but the core ideas are simple once you get the hang of them. Here are some of the most frequent questions I hear from founders, with straight-to-the-point answers.

What’s a Good Customer Churn Rate for a SaaS Business?

A "good" churn rate completely depends on who you sell to. The benchmarks swing wildly depending on your customer base.

Here’s a rough guide:

- For B2B SaaS selling to large companies: Anything under 3% annually is fantastic. These big clients have high switching costs.

- For those focused on small businesses (SMBs): A monthly churn of 3-7% is standard. The best-in-class companies get it below 3% monthly.

If you're just starting, don't obsess over hitting a specific number. What matters more is seeing a consistent downward trend. That shows your product, onboarding, and support are all getting better.

A word of caution: if you're consistently seeing more than 7% monthly churn, that's a serious red flag. It's time to drop everything and figure out what’s broken.

Should I Focus on Customer Churn or Revenue Churn?

You need to track both, but revenue churn is where the real story is. It gives you a much clearer picture of your company's financial health.

Customer churn (or logo churn) is simple: it’s the percentage of customers you lose. Revenue churn, on the other hand, tracks the percentage of monthly recurring revenue (MRR) you lose.

Think about it this way: losing ten tiny accounts might spike your customer churn but barely dent your revenue. But losing just one huge enterprise client could torpedo your revenue churn, even if your customer churn number looks great.

While you should always watch both, make reducing net revenue churn your north star. It’s the metric that truly reflects the financial impact on your bottom line.

How Soon Should I Start Working on Churn Reduction?

Day one. Seriously. Even before you have enough data for a proper analysis, you should be building your company with retention in mind. This isn't just about acquiring users; it's about setting them up for success from the moment they sign up.

This proactive mindset means focusing on a few things from the beginning:

- Nail your onboarding flow: Your top priority is getting new users to their "Aha!" moment as fast as possible.

- Constantly ask for feedback: From your very first customer, make it easy for them to tell you what they love and what drives them crazy.

- Deliver value immediately: Your first version of the product needs to solve a real, painful problem so well that people can't imagine living without it.

Once you have your first 20-30 customers, you can start getting solid qualitative feedback. As you approach the 100-customer mark, it's time to get serious about formal churn tracking—that’s when you'll have enough data to spot meaningful patterns.

At Proven SaaS, we help you find validated business ideas in markets with built-in demand, giving you a head start on building a product customers won't want to leave. Our platform analyzes ad spend to uncover profitable niches where real companies are already succeeding.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders