A Clear Guide to Audience Analysis Demographics for SaaS Growth

What exactly is audience analysis demographics? In simple terms, it's about understanding your customers using clear, factual data. We're talking about key statistics like their age, location, gender, and occupation. This information helps you grasp, on a fundamental level, who they are.

For any SaaS company, this isn't just "nice to have"—it's the first step to ensuring your product, marketing, and message truly connect with the people who need you most.

Going Beyond Guesses to Truly Know Your Customer

If there's one golden rule in SaaS, it’s this: know who you're building for. It sounds obvious, but you’d be surprised how many companies skip this part. Without a crystal-clear picture of your ideal customer, every decision you make is a shot in the dark. This is why a deep dive into audience analysis demographics is so critical.

This process is about swapping assumptions for facts. You might think your users are "young tech professionals," but the data could reveal they are primarily 28-35 year old project managers living in major North American cities. That small shift in understanding isn't just a detail; it's a compass for your entire business.

Why Demographics Are Your Strategic Compass

Demographic data gives you the context you need to make smart decisions across your entire company. It’s not just for the marketing team; it’s the foundation of a truly customer-focused business.

Consider these practical examples of how demographic insights can steer you:

- Product Development: Knowing your users' average age and occupation helps you prioritize features that solve their real, day-to-day problems. For example, if your users are busy sales professionals, a mobile-friendly feature might be more valuable than a complex desktop dashboard.

- Marketing Campaigns: Understanding where your audience lives and their typical income level lets you craft ad campaigns that feel personal and fit their budget.

- Content Strategy: When you know the educational background of your users, you can create blog posts, webinars, and tutorials that are genuinely helpful, not just more noise.

> By understanding the "who," you gain powerful clues about the "what," "where," and "why" of your customer's journey. It transforms your approach from broadcasting a generic message to having a meaningful conversation.

A solid grasp of your audience's demographics ensures you’re building a solution for real people, not just a cool piece of software. That focus is what separates the SaaS companies that thrive from those that just stumble along.

The Demographic Metrics That Drive Decisions

Once you commit to a data-driven approach, the next question is: which data actually matters? For a SaaS founder, the goal is to zero in on the audience analysis demographics that provide sharp, actionable insights.

Think of these key metrics as the building blocks of your customer profile. Each one adds another layer of detail, helping you see not just who your users are, but what they need, how they think, and where you can find them. This clarity is invaluable for everything from product development to marketing spend.

The Most Impactful Demographic Metrics

Let's dig into the handful of metrics that provide the most value. These data points directly shape user behavior, buying power, and tech preferences, making them absolute gold for your SaaS strategy.

Here are the metrics that fuel the smartest business moves:

- Age and Generation: This is more than a number; it offers clues about tech-savviness, communication preferences, and life stage. For example, a productivity app targeting Gen Z (born 1997-2012) will gain more traction with short-form video on TikTok, while a financial tool for Baby Boomers might perform better with detailed guides on Facebook.

- Location (Geographic Data): Knowing where your users are helps with everything from marketing language to regional needs. For instance, a SaaS tool for real estate agents in the U.S. will require different features than one for agents in Europe due to varying market regulations.

- Income Level: This metric directly relates to purchasing power and price sensitivity. It helps you design subscription tiers that your audience can afford while still being profitable. A high-income user base might pay for premium, time-saving features, while a budget-conscious group will prioritize affordability.

- Occupation and Industry: Understanding what your users do for a living is a game-changer for B2B SaaS. It shines a light on their daily frustrations and professional goals, allowing you to tailor your product's pitch to solve the exact problems they face.

Core Demographic Metrics and Their Business Impact

This simple table breaks down these core metrics and shows exactly why they're so critical for making strategic decisions for your SaaS.

| Demographic Metric | What It Tells You | Why It's Important for SaaS |

|---|---|---|

| Age & Generation | Life stage, tech adoption rates, preferred communication styles. | Informs marketing channels, UI/UX design, and content format (e.g., video vs. blog posts). |

| Location | Cultural nuances, regional needs, time zones, and legal constraints. | Crucial for localization, targeted ads, pricing strategy, and feature relevance. |

| Income Level | Purchasing power, price sensitivity, and willingness to pay for premium features. | Directly guides your pricing tiers, freemium models, and upselling opportunities. |

| Occupation & Industry | Daily workflow, professional pain points, software budgets, and industry jargon. | The foundation for B2B product-market fit, value proposition, and sales messaging. |

Each data point is a piece of the puzzle. When you put them together, you get a complete picture of your ideal customer.

Connecting Metrics to Business Strategy

Just collecting data isn't enough—the real value comes when you connect it to your business goals. For example, combining occupation data with income levels can help you uncover a profitable niche you might have otherwise missed. If you want to dive deeper into this, check out our guide on how to find profitable niches for your next big idea.

> By focusing on these core demographic metrics, you move from collecting random data points to building a strategic framework. Each metric acts as a lens, bringing your ideal customer into sharper focus and guiding you toward decisions that create real growth.

Where to Find Actionable Demographic Data

Knowing what demographic data you need is one thing, but where do you actually find it? The good news is you don't need a massive budget or a team of data scientists to get started with your audience analysis demographics. Much of this information is hiding in plain sight.

You can often begin by looking at the tools you already use every day. These platforms are full of insights about the people who follow you, visit your website, and interact with your brand. It’s all about knowing where to look.

Tap into Your Existing Analytics

The most direct source of demographic data comes from your own digital properties. These analytics provide a clear look at who is already engaging with you, offering a solid foundation for your research.

Here are the best places to start digging:

- Google Analytics 4 (GA4): Your website is a goldmine. Head to the "Demographics details" report in GA4 to see a clean breakdown of your visitors by age, gender, city, and country. This shows you exactly which groups find your content most useful.

- Social Media Insights: Platforms like Instagram, Facebook, and LinkedIn have powerful, built-in analytics dashboards. You can easily see the age ranges, gender split, and top locations of your followers.

Customer Relationship Management (CRM) Data: Your CRM contains direct information about your actual* customers. Analyzing data from sign-up forms or sales notes can reveal patterns in job titles, company sizes, and industries.

This GA4 report, for example, gives you an immediate visual of where your users are coming from.

A quick glance at a chart like this reveals which countries are driving the most traffic. That insight helps you decide where to focus your marketing spend or if you should consider localizing your product.

Actively Collect Your Own Data

Analytics tools show you what's happening, but sometimes the best way to get the full story is simply to ask. Proactively collecting your own data is a fantastic way to fill in the gaps and add more color to your demographic profile.

> The simplest way to understand your audience is often the most overlooked: just ask them. A short, well-designed survey can provide more clarity than weeks of data analysis.

Customer surveys are perfect for this. Using simple tools like SurveyMonkey or Typeform, you can create quick questionnaires to gather specific details. Ask about job roles, primary work challenges, or how they first heard about you. This not only gives you hard data but also uncovers the "why" behind their behavior. To see how this fits into a bigger plan, check out our guide on conducting effective SaaS market research.

The sheer size of social media also offers a huge opportunity for insight. By early 2026, global social media penetration hit 63.9%, and a platform like Facebook has over 3.065 billion monthly active users. That user base, which is 56.8% male, is an enormous sample size for spotting broader demographic trends.

You can find more details about these social media statistics. By combining what you see in your analytics, what you learn from surveys, and what you observe from broader market data, you'll build a well-rounded and genuinely useful view of your audience.

Turning Raw Data Into Powerful Customer Personas

So, you’ve gathered a ton of demographic data. That's great, but right now, it’s just a list of numbers and labels. To make it truly useful, you need to give it a human face. This is where creating customer personas comes in, and for any SaaS business looking to master audience analysis demographics, it's a game-changer.

Think of a persona as a fictional character that represents your ideal customer. It’s how you turn abstract data points into a relatable story that your whole team can understand and use.

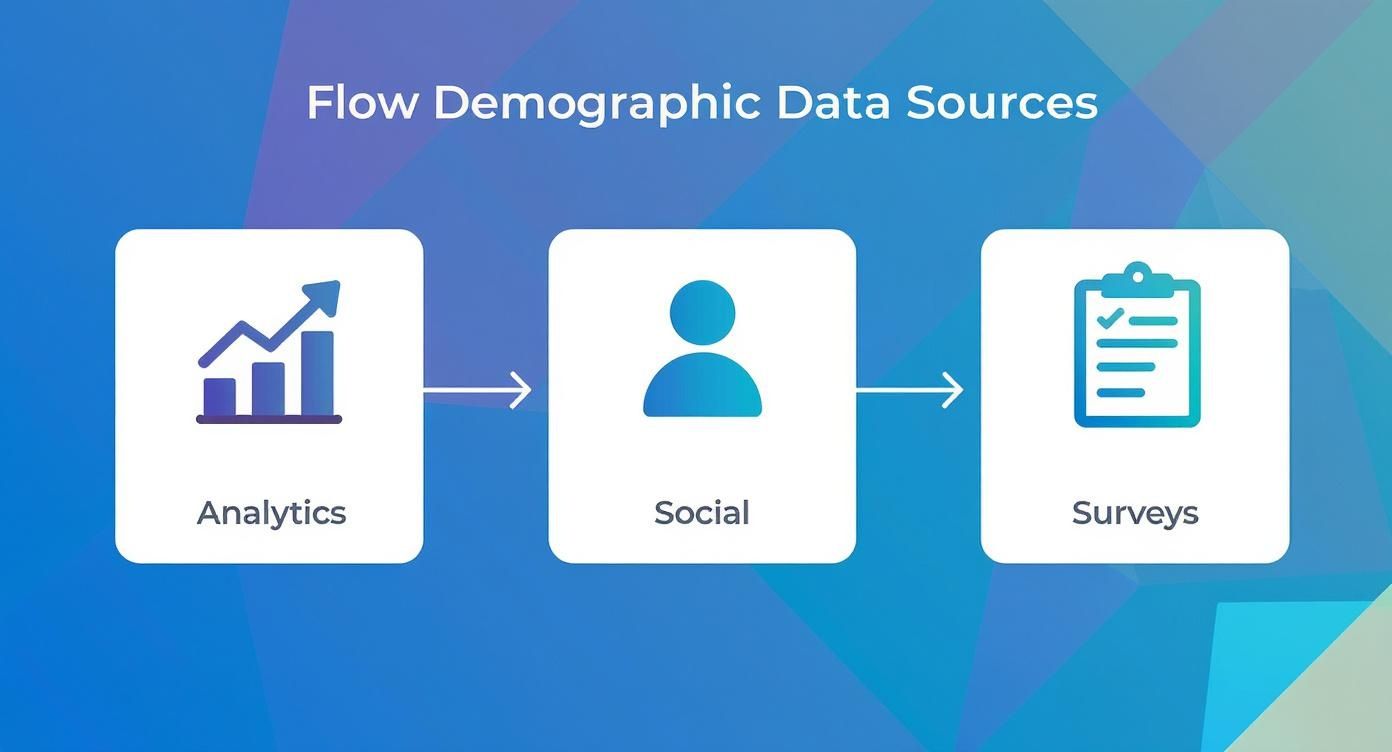

This infographic shows how you can source that raw data to start building out these personas.

As you can see, it’s all about pulling information from web analytics, social media, and direct surveys to paint a complete picture.

From Data Points to a Detailed Persona

Let’s walk through a practical example. Imagine your analysis uncovers a core customer segment that looks like this: "Female, 28, Urban Location, Marketing Manager." It's a solid starting point, but it's not very inspiring.

Now, let's bring those stats to life by creating a persona. We'll call her "Marketing Megan."

- Demographics: She’s a 28-year-old woman living in a tech hub like Austin. She’s a Marketing Manager at a mid-sized tech company.

- Goals: Her main goal is to prove the ROI of her campaigns to her boss. She's aiming for a promotion to a Director role in the next two years.

- Pain Points: Megan is drowning in data. She’s constantly jumping between different analytics platforms, hates building reports, and feels like her best creative ideas are getting buried in spreadsheets.

- Motivations: Efficiency is her north star. She loves anything that produces measurable results, saves her time, and makes her look like a rockstar to her leadership team.

See the difference? "Female, 28" just became a real person with real problems—problems your SaaS can solve. You're no longer building a feature for a generic user; you're building it specifically for Megan. That shift in perspective is incredibly powerful.

To get even better at connecting these dots, you should check out these SaaS business intelligence tools. They can help you pull all this kind of information together.

How Personas Drive SaaS Growth

When you have well-defined personas like "Marketing Megan," everyone on your team is suddenly on the same page, working to solve the same person's problem.

> A customer persona isn't just a marketing exercise. It's a strategic tool that anchors every business decision to a human need. It’s the constant reminder of who you’re serving and why it matters.

Here’s how SaaS companies put personas to work every day:

- Refine Messaging: Your ads, landing pages, and emails can speak directly to Megan’s frustrations and ambitions, using language she actually uses.

- Improve Onboarding: The onboarding flow can be designed to guide her straight to a quick win, like creating her first beautiful report in under five minutes.

- Guide Feature Development: When the product team debates a new feature, they can ask, "Would this really help Megan do her job better?" This question acts as the ultimate filter, cutting out noise and keeping the product focused on what truly matters.

- Before (The "Spray and Pray" Method): You spread your limited marketing budget thinly across Facebook, LinkedIn, and Instagram, running the same professional ad everywhere. The results are underwhelming.

- After (The Targeted Approach): Knowing your audience lives on visual, fast-paced platforms, you shift 80% of your budget to TikTok and Instagram Reels. Instead of corporate-speak, you create short, punchy videos showing how your tool makes boring tasks fun, set to trending audio. The results? A massive jump in engagement and a lower cost per acquisition.

- Before (The One-Size-Fits-All Plan): To attract more users, you offer a single, low-priced monthly plan. But you notice a high churn rate; customers sign up but cancel a month later without using the advanced features.

- After (The Value-Based Tiers): You introduce a tiered pricing model. This includes a premium "Enterprise" plan packed with advanced features and dedicated support, priced to reflect the immense value it provides to high-earning professionals. Your ad copy now focuses on their specific pain points.

- Mind Cultural Sensitivities: Before launching in a new market, do your homework. Research local customs, understand color symbolism, and get a feel for communication styles to avoid costly mistakes.

- Highlight Relevant Features: Does your SaaS help with GDPR compliance? That’s a huge selling point in Europe. Does it integrate with a payment platform that’s dominant in Latin America? Lead with that.

- Translate with Context: Don't just use an automated translator. Hire native speakers to ensure your marketing messages feel natural and authentic, not robotic.

- Google Analytics 4 is packed with information about who’s visiting your website.

- Social media insights on platforms like LinkedIn and Instagram will show you a breakdown of your followers.

- Simple customer surveys using free tools like Google Forms can fill in any missing pieces.

Putting Your Demographic Insights Into Action

Collecting data is one thing, but it’s what you do with it that counts. The real value of audience analysis demographics emerges when you embed those insights directly into your business strategy. This is the moment your research starts to impact how you connect with customers.

Think of it as connecting the dots between who your audience is and what they want from you. Every demographic detail—from age to income—is a clue. It tells you how to shape your messaging, where to spend your marketing budget, and even how to price your product.

From Age Data to Channel Selection

Let's walk through a clear example. Say you've built a project management tool with a sleek, gamified interface designed for a younger crowd. Your demographic analysis confirms it: your ideal users are mostly Gen Z and younger Millennials, aged 18-30.

This is a perfect illustration of how age data should drive your channel strategy. It’s no secret that younger audiences flock to certain platforms. On Instagram, for instance, users aged 18-24 and 25-34 make up 31.7% and 30.6% of the entire user base respectively. Knowing this helps you focus your resources where they will make a difference. You can find more Instagram user stats on getphyllo.com to see just how deep this data goes.

Aligning Pricing with Income and Occupation

Now, let's consider a different SaaS—a high-end financial analytics platform. Your research shows your ideal customers are senior financial analysts and portfolio managers with significant professional experience and higher incomes.

> By aligning your pricing and messaging with the financial reality and professional needs of your audience, you attract more qualified leads who see your product not as a cost, but as a critical investment.

Suddenly, you’re attracting higher-value customers who stick around longer. They’re actually using the features you worked so hard to build. This is the power of putting your data to work.

Adapting Your Strategy for a Global Audience

https://www.youtube.com/embed/UiyTPLvB6Y8

In today's connected world, your next customer could be anywhere. But if demographic audience analysis teaches one thing, it’s that a one-size-fits-all strategy is a surefire way to fail when scaling globally.

Your product’s messaging might be a home run in North America, but that same message could miss the mark completely in Southeast Asia. This isn't about the product; it's about cultural differences and regional priorities that change how people see your software.

Geographic distribution is more than pins on a map. For example, YouTube viewing habits paint a clear picture of these regional divides. The Asia-Pacific region is the platform's biggest audience, making up 30% of all global views, while Europe and North America are tied at 27% each. This shows that to gain traction, creators must tap into local tastes—whether that’s K-pop, regional food trends, or local humor. For more details, check out these YouTube user statistics available on Global Media Insight.

Actionable Steps for Global Adaptation

So, how do you turn this geographic data into a growth plan? The key is localization, which goes far beyond simple translation. It’s about adapting your content, marketing, and even product features to solve region-specific problems.

When you tailor your approach this way, you’re showing each market that you understand them. That’s how you build the trust needed to expand successfully across borders.

Frequently Asked Questions

Have a few more questions about putting demographic analysis to work? You're not alone. Let's tackle some of the most common ones for SaaS founders and marketers.

How Often Should I Check My Audience Demographics?

Think of this as a regular health check for your marketing, not a one-time task. A deep dive once a year is a good baseline to ensure you’re still on track.

That said, if you're in a fast-moving market, consider more frequent check-ins. It's also smart to re-evaluate after a major product launch or if you notice a significant change in customer behavior. This keeps your strategy aligned with who your customers are today.

> Demographics aren't set in stone. Your audience is always evolving, and so should your understanding of them. Regular check-ins keep your insights sharp and your marketing effective.

What's the Real Difference Between Demographics and Psychographics?

This is a great question. Getting the distinction right is key to deeper marketing insights. They are two sides of the same coin, working together to give you a complete customer profile.

Demographics tell you who your audience is—the objective facts like age, gender, and location. Psychographics tell you why they buy, by exploring their values, interests, and lifestyle. Think of it this way: demographics help you find your audience, while psychographics help you speak their language.

Can a Startup Really Do This on a Tight Budget?

Absolutely. You don't need a massive budget to get powerful demographic data, especially in the early stages.

Start by tapping into the free resources you already have access to.

And don't forget the power of conversation. A few chats with your first customers can provide incredibly rich data for the cost of a coffee.

---

Stop guessing and start building with confidence. Proven SaaS gives you the data-backed intelligence to find profitable SaaS ideas that already have proven market demand. Find your next winning idea today.

Build SaaS That's

Already Proven.

14,500+ SaaS with real revenue, ads & tech stacks.

Skip the guesswork. Build what works.

Trusted by 1,800+ founders